Last week was a nasty one for the market, and while some holdings fared better than others, there was definitely some bloodshed in the portfolio. But I still like Agnico Eagle Mines Ltd. (AEM), writes Clif Droke, editor of Cabot Turnaround Letter.

AEM was just downgraded to “Neutral” from “Buy” with a $110 price target at UBS. The bank believes Agnico will continue to deliver against its guidance while generating robust free cash flow and increasing cash returns to shareholders. But it sees “limited near-term volume growth” and believes the company would need to “re-rate further to justify material upside with gold at $3,000 an ounce.”

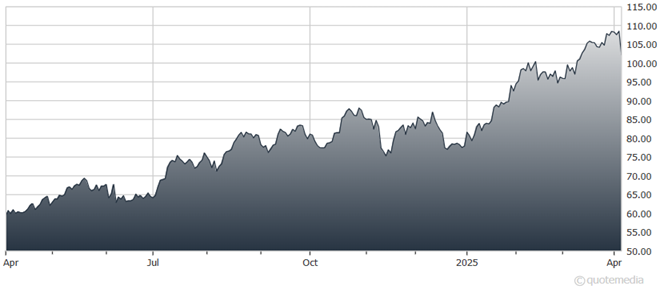

Agnico Eagle Mines Ltd. (AEM)

The analysts at UBS further said Agnico’s relative valuation looks “stretched” after an outperformance that was driven by industry peers struggling against production guidance, cost inflation, and questionable M&A track records. UBS also noted that at 8.2x its spot enterprise valuation-to-EBITDA, Agnico now trades in line with its five-year average multiple and implies the stock is discounting a more than $3,000 gold price.

I happen to disagree with the firm’s assessment of AEM’s upside being limited. Instead, I see AEM as a continued prime beneficiary of the ongoing secular gold bull market, which is being driven by a number of catalysts — not the least of which is the persistence of global economic uncertainties.