Most investors chase AI, semiconductors, and the latest crypto buzz. But one of the most explosive trades of the year is hiding in plain sight. That trade? Copper, writes Nicholas Vardy, editor of The Global Guru.

The red metal is quietly approaching a new all-time high. Commodities giants like Mercuria and Trafigura predict copper will surge past $12,000 per ton. That's well above the $11,000 highs we had seen in 2024.

But this isn’t another hype-fueled moonshot. It’s not driven by Reddit threads or TikTok influencers. Copper’s story is rooted in macro fundamentals. And the world is only just beginning to notice. If you’re a contrarian investor looking for the next asymmetric bet, copper may be your best bet.

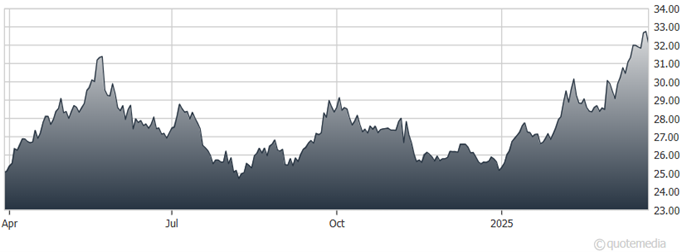

United States Copper Index Fund (CPER)

Copper isn’t just an industrial metal. It’s the wiring of the global energy transition. Electric Vehicles (EVs) demand four times the copper of their internal combustion cousins. Solar farms, wind turbines, and battery storage all run on copper. Even the AI-driven data centers capturing Wall Street's fancy rely heavily on it.

And while demand soars, supply is stagnant. Bringing a new copper mine online takes 10 to 15 years. Regulations and rising geopolitical tensions in Chile and Peru only add more friction.

The result? A textbook imbalance. Demand rising. Supply stagnating. And prices are starting to reflect the pressure.

The US is also reportedly considering tariffs on imported copper just as it did with steel and aluminum. Traders are already front-running the move. Reports suggest over 400,000 tonnes of copper are headed to the US as buyers rush to beat potential tariffs.

If tariffs happen, US copper markets could tighten sharply. Domestic producers stand to benefit. Prices could spike. And we’ll have yet another politically driven catalyst on our hands.

Here are some ways to play it:

1. Copper ETFs

2. Major Miners

3. Junior Miners

4. Options Strategies

5. Copper Futures (for advanced traders)

Size your positions accordingly.