Bristol-Myers Squibb Co. (BMY) traces its corporate beginnings back to 1887. Today, the company is a leader in developing innovative drugs like Eliquis for stroke prevention and Opdivo for cancer immunotherapy, writes Ben Reynolds, editor of Sure Retirement.

BMY generated $48.3 billion in revenues last year. It now trades at a market cap of about $112 billion.

Meanwhile, on Feb. 6, Bristol-Myers reported Q4 results. Revenue grew 7.5% to $12.3 billion, exceeding estimates by $740 million. Adjusted earnings per share (EPS) were $1.67, down slightly from $1.70 the previous year but $0.20 above expectations.

Adjusted gross margins contracted 240 basis points to 74%. US revenue increased 9% to $8.6 billion, while international sales also grew 9% to $3.7 billion. Eliquis, a top-selling anticoagulant, saw an 11% increase to $3.2 billion, while Revlimid declined 8% to $1.34 billion. Camzyos surged 153% to $223 million, Opdivo increased 4% to $2.48 billion, and Reblozyl rose 71% to $547 million.

The company benefits from the defensive nature of the pharmaceutical industry, as demand for its lifesaving drugs remains steady regardless of economic conditions. Its competitive advantage lies in its robust pipeline, high-margin pharmaceutical products, and strategic acquisitions, such as the 2019 purchase of Celgene, which notably expanded its presence in oncology and immunology.

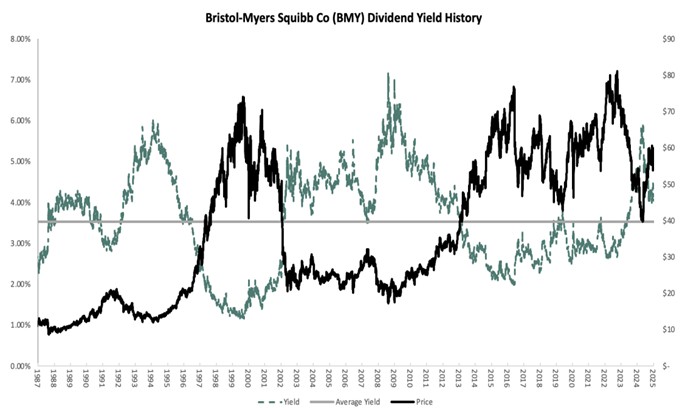

BMY has also grown its dividend annually for the past 18 years, a track record we expect to keep rising for years to come. Today, the stock’s payout ratio stands at a healthy 37% based on the midpoint of management's adjusted EPS target range for this year.

The company is now trading at 8.9 times its forecasted EPS of $6.70 for this year. This is below our fair multiple of 11 times. We believe a valuation multiple expansion could boost annual total returns by 4.3%. When combined with the 3% expected growth rate and the 4.1% dividend yield, this implies a 10.9% expected total annual return over the next five years.