I’m back behind my desk after participating in the Swiss Mining Institute’s March Conference. While gold may be at the start of a mild near-term correction after becoming overbought, silver is looking less overbought and may hold up, advises Peter Krauth, editor of Silver Stock Investor.

We enjoyed the inevitable fondue dinner that facilitated lots of great networking, then spent the next two days in meetings with companies of all stripes. The mood was unsurprisingly upbeat with gold near record highs above $3,035 and silver flirting with $34.

On the macro side, there was considerable talk of tariffs and a coming global reordering and how that is extremely bullish for precious metals. On the mining side, many experts suggested that merger and acquisition activity should pick up, and that near-term developers could be the most likely targets.

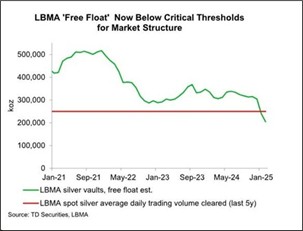

Focusing on silver, the physical market remains abnormally tight with lease rates many times their normal levels. Flows from London to the New York Comex exchange have been steady, with some 134Moz flowing West in the four months to the end of February.

The flow of metal from London to New York explains some of the jump in lease rates. Still, it’s intriguing that gold lease rates have eased while silver rates have remained elevated.