Tech stocks led the recovery Monday on both sides of the US-Canada border on reports the White House wouldn’t pursue industry-specific tariffs. But we won’t really have an idea until April 2 when the announcements are made. Gold hanging out near record highs indicates there is still a fair bit of defensiveness floating around, notes Amber Kanwar, host of the In the Money with Amber Kanwar Podcast.

“My theory is that US stocks now underperform most when the tariff threat is the highest, because if you believe returns to capital have been greatest under global free trade, then the larger the threat to that, the larger the impact on the ultimate beneficiary of capitalism in recent years, namely US stocks,” surmises Jim Reid at Deutsche Bank.

Still, since the 10% correction on the S&P 500, it has been pretty much a one-way ticket higher with every single sector up, led by energy, tech, and financials.

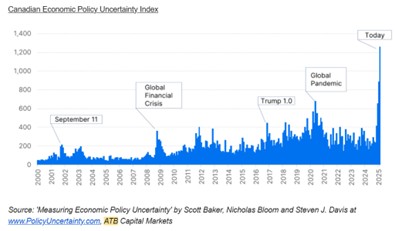

As a result of tariffs, though, economic policy uncertainty in Canada has reached a record high, according to data collected by ATB Capital Markets. Which is pretty wild when you consider that just five years ago the whole world shut down and we never knew when we would be able to breathe the same air as other people.

ATB is focusing on where the opportunity could lie in all of this. Eventually, uncertainty will abate and there could be a pop in stocks that have been hit the hardest by trade anxiety.

“Some of the names that we believe could see some relief with some definition of a tariff regime at potentially lower rates, and also benefit from improved consumer confidence levels, include Air Canada, Cargojet, Exchange Income Corp, and NFI Group,” they wrote.