The key to lower inflation may start with the stock market and feed into the economy, rather than vice versa. The Harvard economist Gabriel Chodorow-Reich estimates that with all else equal, a 20% drop in stocks in 2025 might reduce growth by as much as a percentage point this year, advises Lance Roberts, editor of Bull Bear Report.

The wealth effect describes the behavioral phenomenon where individuals’ perceived wealth changes impact their spending decisions. People tend to feel wealthier when their assets rise in value, even if their income remains unchanged, leading to higher consumption.

Of course, this works in the opposite direction as well. And the wealth effect is particularly relevant to higher-income households today.

Of course, this works in the opposite direction as well. And the wealth effect is particularly relevant to higher-income households today.

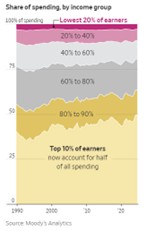

According to S&P Global, the top 10% of households by wealth held nearly 88% of stock and mutual fund shares as of Q3 2024. Furthermore, according to the Wall Street Journal, roughly 50% of all consumption in the US comes from the top 10% of American earners.

Accordingly, the wealth effect may be the first domino in a chain of events that brings inflation back down toward the Fed’s 2% target. As of last Friday’s close, the market had retreated roughly 8% from the February peak.

We certainly aren’t implying that we believe a 20% market decline is coming this year. However, a moderate, sustained market correction could be the Trump Administration’s key to solving the inflation puzzle.