From the peak on Feb. 19 through the end of the 10.1% decline on March 13, bearishness abounded. Besides the percentage of stocks in the S&P 500 (SPX) and Nasdaq-100 having fallen below the level that typically indicated that stocks were “oversold,” the CNN Fear & Greed Index was also solidly in the “Extreme Fear” category, explains Sam Stovall, chief investment strategist at CFRA Research.

Meanwhile, the AAII Investor Sentiment Survey showed a level of caution not seen since the bear market of 2022. As a result, dip-buying investors can’t help but hark back to Baron Rothschild’s quote that “The time to buy is when there’s blood in the streets.” (Of course, after two successive calendar years in which the S&P 500 posted total returns of 25% or more each, a 10% giveback can hardly be called “a bloodbath.”)

However, with Federal Reserve Chair Jay Powell acknowledging that the effect of tariffs on consumer confidence, economic growth, and inflation remain unknown, investors have reason to remain unnerved. We still project 2025 real GDP growth at or above 2% and think inflation will continue to ease through year end, giving the Fed reason to cut interest rates by 25 basis points in June and December.

Also, with S&P 500 EPS growth likely to increase by more than 9% this year, we continue to see an upward trajectory to this market, though with a lowered angle of ascent.

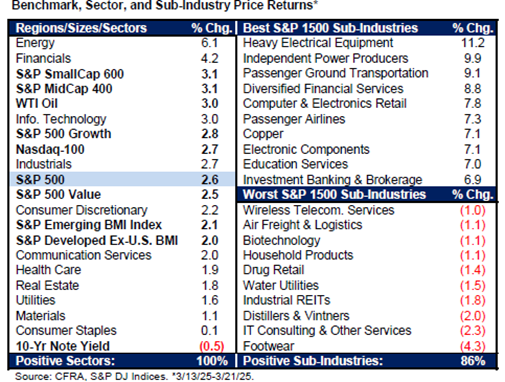

From March 13 through March 21, the S&P 500 gained 2.6%, accompanied by price increases for all sizes, styles, and sectors, along with 86% of the 155 subindustries in the S&P 1500. Leadership was found in the energy, financials, and technology sectors, while weakness was evident in the consumer staples, materials, and utilities groups.

On a sub-industry level, many of the groups that fell the furthest during the correction, such as heavy electrical equipment and independent power producers, rebounded the most. Weakness was evident in the groups most likely to be affected by the trade uncertainty.