One lesson you learn as you get older is how complicated the world can be. Financial decisions can’t be made on a spreadsheet. And even though the world may feel terrible, we’re still a long way away from the dreaded S&P 500 (SPX) “crashes” of old trader lore, observes Callie Cox, chief market strategist at Ritholtz Wealth Management.

Society has a knack for putting things into neat, clean buckets. But unfortunately, reality isn’t so tidy. I’ve thought about this a lot lately amid the stock market commentary that seems to be coming from all corners of the earth now.

As of last week, the S&P 500 had officially dropped 10% from its 52-week high — what Wall Street calls a “correction.” That’s a word you’ve probably heard in panicked tones lately. I sure have – from my pop culture guilty pleasure podcasts to my text threads.

People have painted this selloff as the big, bad Minsky moment that the market had coming. Fear has surged to levels we’ve seen in the depths of past crashes. Panic is overtaking everything.

ATH = All-time/record highs in the stock market

But my sane, measured take is that, well…it’s complicated. Technically, a correction is the midpoint between calm and a crisis. And corrections don’t last forever. In fact, many of them disappear quicker than you think.

Since 1950, the S&P 500 has taken an average of 3.5 months to recover its losses after corrections, and no recovery has taken longer than nine months. In other words, you generally haven’t had to wait more than a year to make your money back from a correction.

While history isn’t gospel, there is a logical explanation here. Stocks tend to bounce back quickly because people eventually realize that the trajectory for the economy and corporate profits hasn’t been significantly harmed.

This is the trajectory we’re on until proven otherwise. And if the economy stays solid – from corporate America’s ability to adjust quickly to obstacles, or because Americans are financially well-positioned from a few years of strong employment and wage gains – then stock prices may be back on track sooner than you think.

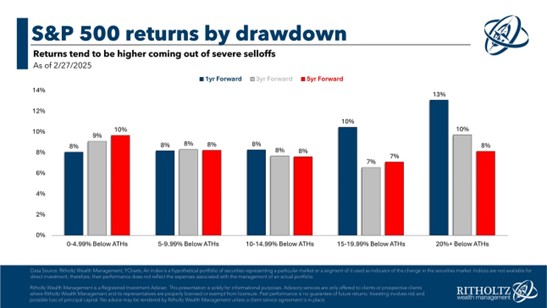

By the way, you can use this knowledge to your advantage. Historically, the best move is to confidently buy during stock market drops. Cycles of fear and relief are the heartbeat of the stock market. You can’t sum them up with just one label.

Feel what you need to feel, but don’t let panic take over just yet.