Energy royalty companies’ cash flows depend not just on realized selling prices from what’s pumped and/or mined from their lands. They’re also affected by the production decisions of the companies operating on their lands. Here’s what I think will happen with variable payouts in 2025, says Elliott Gue, editor of Energy and Income Advisor.

Investors should expect variability in dividends as a matter of course. Right now, benchmark crude oil prices in North America continue to hover just below $70 per barrel. From what we’ve seen so far in guidance, producers as a group are keeping it conservative when it comes to output and Capex.

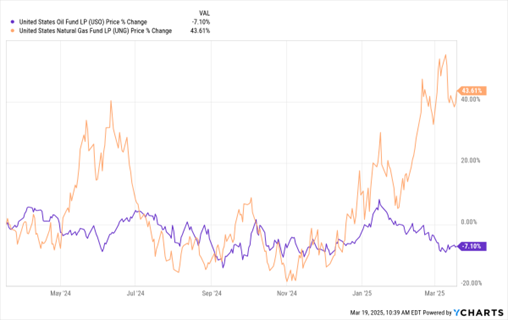

USO, UNG (1-Yr. % Change)

Data by YCharts

Natural gas prices, on the other hand, are considerably stronger they were a year ago. Demand fundamentals look better than they have in years, fueled by power generation and LNG exports. So, the sector is likely at a minimum to benefit from higher realized selling prices this year, even if they keep Capex conservative as seems likely.

It remains to be seen, however, if the likely higher cash flow will result in an increase in the variable rate portion of dividends. In fact, based on management’s past actions, we’d expect a sizeable portion of excess free cash flow to go to buying back stock, as it did last year.

Buybacks are also bullish for these stocks, though. In fact, they may result in more upside than increases in variable dividends. Whatever the case, downside to dividends this year in variable rate stocks appears much less than last year. And it’s a good time to make a bet on these stocks.