John Maynard Keynes is credited with saying, “When the facts change, I change my mind. What do you do, sir?” though there is no definitive evidence that he actually said or wrote it. As for us, we are blinking on the valuation multiple of the S&P 500 and lowering our index targets, notes Ed Yardeni, editor of Yardeni QuickTakes.

Wall Street’s forecasting community (including us) is scrambling both to assess February’s weaker-than-expected batch of economic indicators for January and to reassess the likely near-term negative impact of Trump 2.0.

The Citigroup Economic Surprise Index surprised most forecasters during the second half of last year with positive readings. It has surprised them with slightly negative readings since Feb. 20. We continue to bet on the resilience of the economy. However, we acknowledge that it is being severely stress-tested now by Trump 2.0’s tariff turmoil and shotgun approach to paring the federal workforce

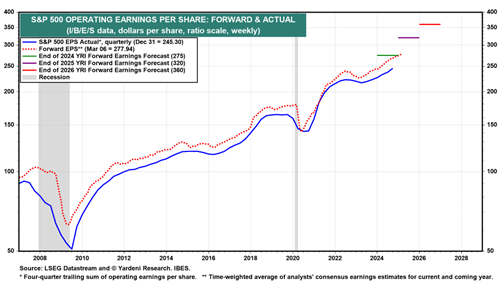

For now, we are sticking with our strong estimates for S&P 500 companies’ aggregate earnings per share of $285 this year and $320 next year. We are still targeting forward earnings per share — i.e., the average of analysts’ consensus estimates for this year and next, time-weighted to represent the coming 12 months — of $320 at the end of this year and $360 at year-end 2026.

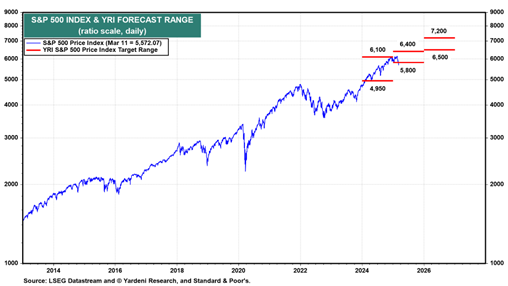

On the other hand, under the circumstances, we are lowering our forward P/E forecasts for the end of 2025 and 2026 to a range of 18-20, down from 18-22. That lowers our best-case S&P 500 targets for the end of this year from 7,000 to 6,400 and for the end of next year from 8,000 to 7,200. The worst-case scenarios using the same forward earnings and the same 18 forward P/E assumptions would be 5,800 and 6,500 for this year and next year.

That’s if President Trump relents, as we expect he will, to avoid a recession that would cost the Republicans their majorities in both houses of Congress in the mid-term elections in late 2026.