The amazing pace of news from the new administration since January 20 has stunned analysts and investors alike. Among the array of new policy items, the threats, implementation, and potential effects of tariffs have been the most disruptive. One fund I like here is Vanguard International Growth Fund (VWIGX), says Brian Kelly, editor of MoneyLetter.

Levies on our three biggest trading partners (Canada, Mexico, and China) have officially been applied, and now it looks like Europe will be part of the mix. The concept of widespread tariffs — all three trading partners have announced retaliatory tariffs on US goods — has stoked worries about inflation and (slower) economic growth.

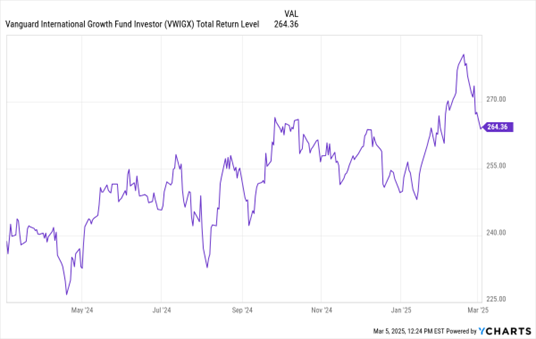

Vanguard International Growth Fund (VWIGX)

Data by YCharts

The concerns are legitimate. However, as we mentioned in a previous issue, we don’t really know (and won’t know for some time) what the end effects will be. It is this uncertainty that is fueling market volatility.

After two years of relatively smooth sailing, we’ve hit some turbulence. We get it…it’s not fun. But in a way, investors are spoiled. A 10% pullback is probably overdue after two consecutive years of 20%+ gains in the S&P 500. We have been talking about potential volatility for quite a while.

As for VWIGX, it can benefit from a pivot toward foreign market outperformance. The fund invests mainly in the stocks of companies located outside the US and is expected to diversify its assets in countries across developed and emerging markets. In selecting stocks, the fund's advisors evaluate foreign markets around the world and choose large-, mid-, and small-capitalization companies considered to have above-average growth potential.

Recommended Action: Buy VWIGX.