I’m bullish on AES Corp. (AES), which delivered on earnings and EBITDA guidance for 2024 and guided to 60% growth in renewable energy EBITDA for 2025. The company has significantly de-risked both its operating facilities and projects in development by locking in long-term contracts with the world’s leading Big Tech firms, writes Roger Conrad, editor of Conrad’s Utility Investor.

It also has “safe harbor protections” for tax credits, a US supply chain behind tariff walls, and US-dollar receivables for assets outside the US. AES’ regulated utilities will see 11% annualized rate base growth through 2027 under pre-approved investment plans. And its DPL unit in Ohio is on track to restore investment grade metrics next year.

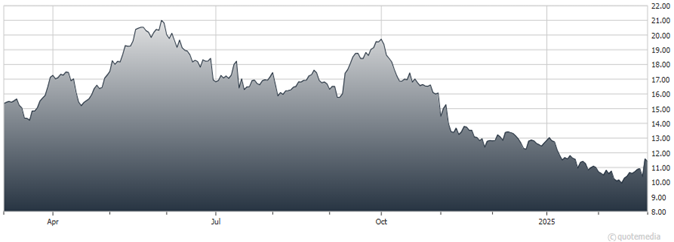

AES Corp. (AES)

Before AES’ news, a large number of investors seemed to believe the company’s growth guidance was on the verge of collapse, citing less renewable-energy-friendly US energy policy and debt costs. A good read of these results should go a long way to calming those fears.

That includes guidance for $300 million of cost savings and a reduction in net debt to EBITDA to the 1-to-1.5 times range. The key catalyst for improvement is simply completing projects already in backlog, boosting cash flow, and removing roughly $5 billion in construction debt from the books.

Management also noted during the earnings call that there’s been “no downturn in demand,” with 450 megawatts of contracts signed with Big Tech customers the last three months alone. Judging from some of the questions and comments during the earnings call, AES still has a number of skeptics. But these results and guidance have greatly increased my comfort level sticking with the stock, especially at a price of just 5.3 times the mid-point of the 2025 earnings guidance range of $2.10 to $2.26 per share.

Management also reaffirmed projected 5% to 7% EBITDA growth through 2027, along with 7% to 9% earnings growth.

Recommended Action: Buy AES.