Will there be a new natural gas pipeline for New York and New England? The region could arguably use one. But in the US, there’s no place for energy investment like Texas and the Gulf Coast, where Kinder Morgan Inc. (KMI) just announced a major pipeline and supply deal with utility Entergy Corp. (ETR), advises Elliott Gue, editor of Energy and Income Advisor.

Oil and Liquefied Natural Gas (LNG) are once again providing a distressingly high portion of the NY/NE region’s winter energy — even though cheap Appalachian gas can be found nearby. But it’s far more likely US oil and gas companies will continue to focus their real long-term spending projects on regions more friendly to fossil fuels.

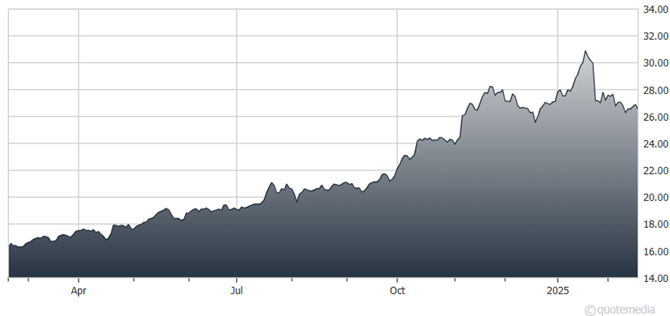

Kinder Morgan Inc. (KMI)

Entergy’s main interest in Kinder’s gas is to supply reliable power to rapidly reshoring manufacturing and heavy industry in the Port Arthur corridor. And the need to get more Permian Basin gas to that market is also behind Energy Transfer LP’s (ET) decision in December to build the two-phase, 400-mile Hugh Brinson Pipeline entering service by “end 2026.”

For the past decade or so, major US midstream energy companies have funded capital spending and dividends entirely with operating cash flow. That remains the case with this new Capex surge. And all of these projects are all heavily, if not fully, contracted before final investment decisions are made.

Midstream companies’ conservatism is part and parcel of the same shale discipline exercised by producers. And there’s no “build it and they will come” mentality, such as we saw at the peak of the last cycle in 2024-2025. That’s good reason to expect the long-term energy upcycle has a long way to run.