Gold is over $2,900 an ounce and headed for $3,000, largely due to global uncertainty and strong central bank purchases by China and other countries. The SPDR Gold Shares ETF (GLD) is ahead nearly 11% in six weeks. I also like Kinross Gold Corp. (KGC), writes Mark Skousen, editor of Forecasts & Strategies.

Here’s a surprise: Which is up more over the past 25 years — gold or stocks? The average investor would answer stocks. But the correct answer is gold.

(Editor’s Note: Mark Skousen is speaking at the 2025 MoneyShow/TradersEXPO Las Vegas, which runs Feb. 17-19. Click HERE to register)

As the Wall Street Journal reported recently, the S&P 500 — including dividends — returned 525% between 2000 and the end of 2024. But gold increased by more than 800% over the same period, jumping from $281.63 an ounce to $2,603.01.

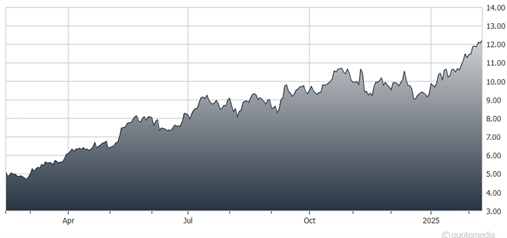

Kinross Gold Corp. (KGC)

It remains a great inflation hedge. And mining stocks are a good way to play it. That brings me to KGC. It yields only 1%, but is now up 30% for us.

Recommended Action: Buy KGC.