“Reversion to the mean” should still be a top investing theme for 2025, with more loaded laggards vaulting to the front and the highest-flying stocks coming back to earth. Brookfield Renewable Partners LP (BEP) is my top pick for conservative investors this month, notes Roger Conrad, president of Conrad's Utility Investor.

So far this year, more money has been going into market favorites than turnaround stories. And the result is 15 Conrad’s Utility Investor portfolio stocks sell above my highest recommended entry points, with three meriting taking profits.

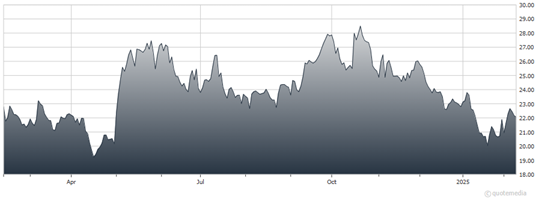

Brookfield Renewable Partners LP (BEP)

No doubt political turmoil, doubts about future Federal Reserve rate cuts, and resulting stock market volatility have increased reluctance to bet on turnarounds. In fact, given the market’s ups and downs, it has surprised me to see the Utilities Select Sector SPDR ETF (XLU) off to such a solid start, up around 3% year-to-date recently.

As for Brookfield, it is a globally diversified, multi-technology owner and operator of clean energy assets. The company's portfolio consists of hydroelectric, wind, solar, and storage facilities in North America, South America, Europe, and Asia, and totals approximately 21 gigawatts of installed capacity. You can take your pick between the tax-advantaged partnership units (BEP) or the slightly more expensive C-Corp shares (BEPC).