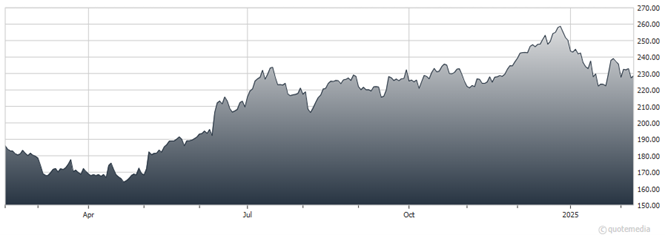

Apple Inc. (AAPL) rose 3% in the aftermarket on Jan. 31 after the company posted fiscal 1Q25 (calendar 4Q24) GAAP EPS and revenue that topped consensus expectations. Apple is on track for high-single-digit to low-double-digit EPS growth over the next two years, observes John Eade, president of Argus Research.

This reflects a strong appetite for Apple’s hardware, and its brand loyalty, in turn, spurs demand for Apple’s services, including App Store, iCloud, and much more. The company, in our view, benefits from aggressive shareholder-return policies and from a perpetually refreshed roster of desirable products.

We believe the current environment represents an opportunity to establish or dollar-average into positions in AAPL. Our 12-month target price is $280.

Apple Inc. (AAPL)

As for markets, we have studied the monthly, quarterly, and annual returns in the stock market since 1980. February is not one of the best months. On average, stocks rise less than 0.2% in the shortest month of the year. Only the months of August and September have generated weaker average returns.

There have been some strong Februarys, including 7% gains in 1986, 1991, and 1998, as well as a 5.5% surge in 2015. But there have been some clunkers as well: A 6% drop in 1982; a 9% plunge in 2001 during the “dot-com” bust; an 11% collapse near the bottom of the Great Recession and bear market in 2009; and, of course, the 20% bomb in February 2020, as the coronavirus began to spread around the world and the economy tumbled into a recession.

Last year was better, with a 5.2% gain during the month. This time around, February is starting off with a bit of positive momentum, as January’s returns were strong. Earnings season continues and, as usual, companies are outperforming Street expectations.

While we continue to think that the general fundamentals for stocks are positive (profits are rising, valuations are reasonable, the economy is growing, and rates are headed lower, in our view), we still suggest that equity investors focus on well-managed companies with clear growth prospects and clean balance sheets -- especially in February.