“Let’s Give Growth a Chance” is my idea for a new song for the new administration. It will solve our debt problems. Just as my Magnet model looks for revenue growth, we should not be focused only on cost cutting, writes Jordan Kimmel, founder of MagnetInvesting Insights.

Meanwhile, over half of all public companies’ stock prices are now above their own 200-day moving averages. This is up dramatically from only 25% last year. Money has already begun to shift out of the handful of favorites. This is positive for the markets, just not for the indexes.

(Editor’s Note: Jordan Kimmel is speaking at the 2025 MoneyShow/TradersEXPO Las Vegas, which runs Feb. 17-19. Click HERE to register)

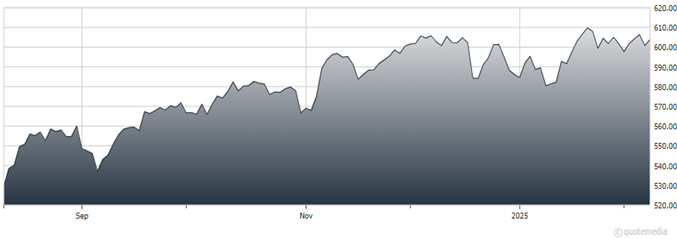

SPDR S&P 500 Trust (SPY)

That said, the new 52-week low list expanded again. The advance/decline lines have once again deteriorated and look too weak for comfort. This is a dangerous market. Do not chase anything here. Be patient. Even great stocks pull back.

As for the economy, inflation is 3%, while bonds yield 4.5%. Move on. There is not much more to think about here. This is a time to own rather than lend. You just need to own the right things.

The pro-growth and America-first policies of the new administration are the real key. They have kick-started small business, consumer, and stock market optimism. Despite obstacles and potholes, the environment is now set for winners to win. Just do not count on a straight line up.