“Well begun is halfway done,” according to the famed market analyst Mary Poppins. While this truism gains more gravitas when credited to its original author, Aristotle, both the nanny and the philosopher were correct: A good start is important. And that’s just what the gold market of 2025 achieved in January, notes Brien Lundin, head of market research at The Daily Rip by Stocktwits.

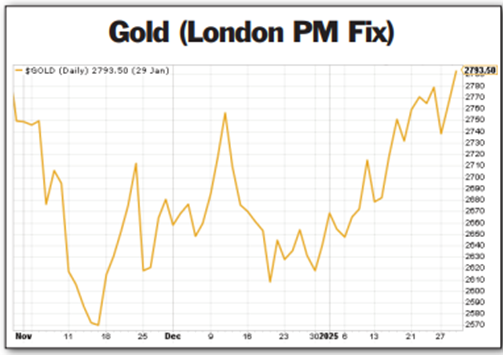

As the accompanying chart shows, while December didn’t live up to the traditionally strong market seasonality, the new year has lived up to expectations/hopes in great fashion.

We ended 2024 in the low $2,600s and are finished up January in the mid-$2,700s. Not bad, especially considering we spent some time threatening the $2,800 level and in some markets set new record highs in the futures price.

The reasons for this run in gold are varied, but in my mind the animating factor behind the global rush for the yellow metal isn’t so much investment, but rather insurance.

The primary reason to hold physical gold is to preserve the purchasing power of your wealth against ever-depreciating fiat currencies. Thus, it’s a hedge, or insurance, against something you know is going to happen, with only the rate of depreciation in question.

Meanwhile, shifts in global portfolio allocations toward the safe haven of gold have driven the price of that asset ever skyward. Because, facing a future that is as uncertain, risky and leveraged as ever before, smart investors find comfort in an investment that can benefit no matter what happens.