BellRing Brands Inc. (BRBR) reported fiscal fourth quarter results ahead of expectations. Results were helped by continued solid growth in the overall convenient nutrition category, with ready-to-drink outpacing overall category growth, showcases Doug Gerlach, editor of Investor Advisory Service.

Sales in Q4 increased 18%, as a 19% increase in volumes was offset by a 1% decline in price/mix. Premier Protein sales grew 20% with strength in both shakes and powders, while Dymatize grew 4% on a 7% increase in volumes.

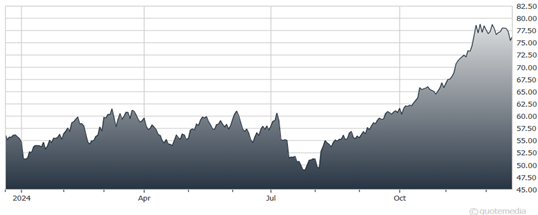

BellRing Brands Inc. (BRBR)

After adjusting for a mark-to-market gain on commodity hedges and other one-time items, gross margin increased to 35.2% from 32.7% in the year ago period. SG&A deleverage from higher marketing costs resulted in 44% growth in operating profit. EPS advanced more than 50% to $0.55. For the full year, BellRing reported sales growth of 20% and EPS of $1.86, also up more than 50%.

Management’s outlook for fiscal 2025 is for sales growth of 12%-16% with Premier Protein up mid-teens and Dymatize growing mid-single digits. Adjusted EBITDA is forecast to increase 5%-11%, held back by increased marketing costs and input cost inflation, as protein costs are projected to be less favorable than in the prior year.

For Q1, BellRing expects sales growth of over 20% with adjusted EBITDA margin meaningfully lower than the 23.4% it reported in the prior year’s quarter due to higher marketing expenses.

Recommended Action: Buy BRBR.