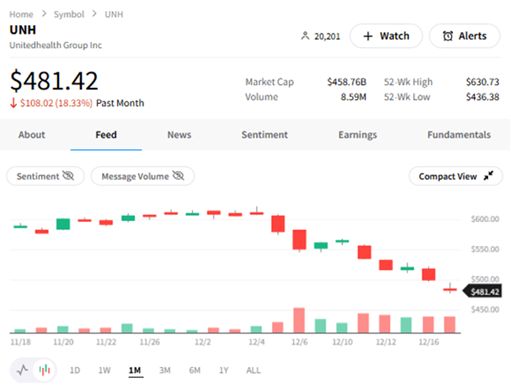

The Dow Jones Industrial Average just notched a nine-day losing streak, its longest since 1978. UnitedHealth Group Inc. (UNH), the second-largest component of the price-weighted index, drove the weakness, highlights Tom Bruni, head of market research at The Daily Rip by Stocktwits.

Your grandfather’s favorite index was down for so long because the market’s latest bout of strength has been isolated to mega-cap tech stocks. It was the longest stretch of downside since 1978, although that sounds scarier than it is.

(Editor’s Note: Tom Bruni is speaking at the 2025 MoneyShow Las Vegas, which runs Feb. 17-19. Click HERE to register)

As for UNH, it has come under pressure over concerns that the incoming Trump Administration’s regulatory overhaul will cut into healthcare profits. But It’s not just UnitedHealth that’s falling. The Health Care Select Sector SPDR (XLV) is now down 13% from its September high, and investors remain cautious about the industry’s prospects.

Still, despite the decline in its leading stocks, 66% of Stocktwits users polled see healthcare’s weakness as a buying opportunity.

After a strong run in 2024, a little December weakness isn’t necessarily a sign of a longer correction ahead. In fact, many are looking for the market to close the year strong on the back of a Santa Claus rally. Wall Street’s stat master Ryan Detrick shared nine reasons his firm still believes in the holiday rally, even after some initial December weakness.

We’ll have to wait and see how it plays out. But for now, retail Investors and traders are doubting the Dow and favoring the other indexes that still have momentum.