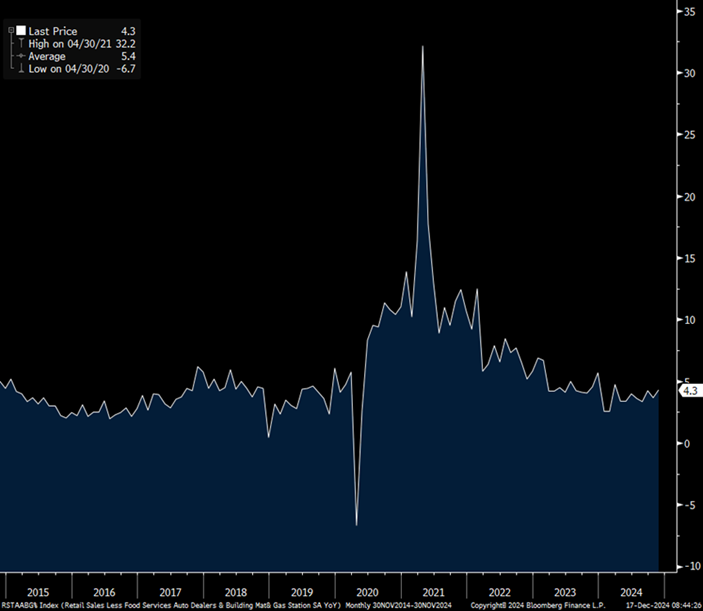

Core retail sales in November rose 0.4% month-over-month, as expected, after a one-tenth decline in October. Not included in the core print was the 2.6% MOM jump in auto sales/parts after a 1.8% rise in October. For perspective, over the past 10 years, YOY core retail sales growth was 5.4%. It was 4.3% in November, notes Peter Boockvar, editor of The Boock Report.

Building materials sales, also outside the core read, were up 0.4% MOM and 2.5% year=over-year. Elsewhere, the spending was more mixed. Sales rose for furniture, electronics, sporting goods, and e-commerce but fell at restaurants/bars, department stores, apparel, food/beverage, and miscellaneous for a second month. Miscellaneous can include dollar stores, convenience stores, pet, flower, etc.

Core Retail Sales YOY

For added context: The top 20% income decile accounts for about 40% of all consumer spending. That highlights the bifurcated consumer backdrop, where the lower-to-middle-income consumer has been much more circumspect with how they spend because of less savings. Meanwhile, the upper-end consumer is helping to support economic growth with a boost from the wealth effect of higher stock and home prices.

Also to keep in mind: With the later Thanksgiving compared to last year, holiday spending likely started much closer to November month end. That makes the December stats more relevant when compared to last year.