Productivity-fueled economic growth can accelerate without producing inflationary pressures. The equation is simple. Meanwhile, we maintain overweights (vs. the S&P 500) in Consumer Discretionary, Financials (not banks), Industrials, and Technology, writes Nancy Tengler, CIO at Laffer Tengler Investments.

Productivity measures output with the resources used to produce a given product or service. If more is produced with less, voila! Productivity improves.

In the early days of 1992, a famous economist and game-theorist friend in a speech to our clients predicted that US GDP would grow by a paltry 1%-2% for the foreseeable future, maybe even forever.

He was wrong. Why? Productivity. The dawn of the Internet, Excel, Windows, and expanding use cases drove growth. It is important to note that supply-side incentives like a reduction in regulations and lower taxes implemented in the 1980s contributed to the productivity boom.

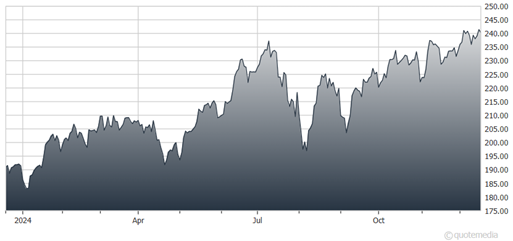

Technology Select Sector SPDR ETF (XLK)

Many of those same incentives are on the table again. The 2017 Tax Cuts and Jobs Act reduced corporate taxes in the US to one of the lowest rates (from the highest) among the developed nations. Corporate tax receipts have doubled since then from $200B to $400B in 2023.

If the second Trump Administration cuts taxes further, we may see a race to the bottom in tax rates among the developed nations, which will drive growth globally. But until then, the US spends more on research and development than the rest of the world and that spending produces real results.

GDP growth in the US dwarfs that of other developed nations. The OECD estimates that the US will grow 2.4% in 2025 – before considering the potentially positive impact of lower corporate taxes and fewer regulations. For now, we expect the US to remain the best house on the global block.

Finally, we have been arguing for two years that we are in the early days of a technology-led bull market. Each summer of the last three we have heard the tech trade is over. The stocks swooned in response...and we added to holdings. We are sure glad we did. We have, of course, also broadened out our sector exposure.