Orogen Royalties Inc. (OGNRF) has sold its Celts property in Nevada to Eminent Gold Corp. (EMGDF) for $400,000 in cash and shares plus a 3% royalty (of which 1% can be bought back for $1.5 million). Celts was generated under the alliance Orogen has with Altius looking for “Silicon lookalikes” in southern Nevada, writes Adrian Day, editor of Global Analyst.

The proceeds and royalty will be split with Altius, who funded the exploration. It is the fourth project thus generated and the second to be sold.

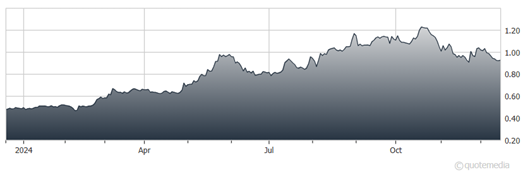

Orogen Royalties Inc. (OGNRF)

With a strong balance sheet and ongoing royalty revenue, as well as a business model that allows it to earn revenue from its prospect-generating business, Orogen is in the enviable position of not needing to raise additional equity. It owns a 1% royalty of the Silicon and Merlin deposits of Anglo, which it is currently seeking offers for. The outcome is uncertain, but in any event, the royalty is a very valuable asset.

The stock price has fallen from its late-October high on fatigue among some short-term traders who bought for a quick sale of the royalty, aggravated in the past few weeks by a well-known fund that had to sell this year. This pullback makes Orogen a good buy.

Recommended Action: Buy OGNRF.