There has been a sharp narrowing in the percentage of the 155 sub-industries in the S&P 1500 trading above both their 50- and 200-day moving averages to 46% from 76%. But treat this as a sign of opportunity, not a troubling omen, says Sam Stovall, chief investment strategist at CFRA Research.

In a recent article, CFRA’s technical analysis arm Lowry Research told clients that by the end of November, many of Lowry’s core indicators reached levels not seen in months or longer. That confirmed the long-term health and staying power of this bull market. Thus far into December, however, strength has waned, causing many of these indicators to diverge from the S&P 500.

Closer inspection by Lowry suggested that the recent deterioration in some of these indicators appears to be the result of the digestion of outsized gains in smaller-cap stocks, rather than the persistent weakness among small-cap issues that typically accompanies the formation of major market tops. As a result, Lowry concludes, investors are likely best served by viewing any pullbacks that should occur as opportunities rather than omens.

What’s more, we see investors being encouraged by the Federal Reserve following through with a 25-basis point cut in the federal funds rate before hinting at an alternate-meeting rate-cutting pace in 2025.

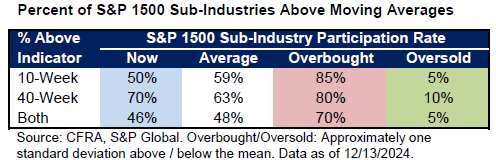

The narrowing of participation continued in the week just passed, as 50% of the 155 sub-industries in the S&P 1500 ended the week trading above their 10-week (50-day) moving average, down from 81% on Nov. 29. In addition, 70% now trade above their 40-week (200-day) average, versus 82%. Finally, 46% of these groups recently traded above both of these averages as compared with 76% as of the end of November.

This narrowing has understandably raised concerns about the possibility of an end-of-year rally. Since 1995, however, whenever the percentage of sub-industries above both moving averages declined from the end of November through mid-December, the S&P 500 rose an average 1.2% by year-end, gaining in price in two out of every three years.