The S&P 500 recently shed some ground. But it rose 24% in 2023, and so far in 2024, it is up around 26%. Meanwhile, PayPal Holdings Inc. (PYPL) hit a 52-week high last Monday after it was upgraded by BofA from Neutral to Buy with a $103 target price, observes Michael Murphy, editor of New World Investor.

If those S&P 500 gains hold, this will mark just the fourth time since the Great Depression nearly 100 years ago that the index rallied more than 20% in back-to-back years. The three prior times were 1935/36, 1954/55, and 1995/96.

After the two boom years in 1935/36, stocks immediately crashed about 40% in 1937. That boom turned into a bust almost immediately. Following the market boom in 1954/55, stocks were flat in 1956 and then dropped 15% in 1957. That boom turned into a bust after about a year.

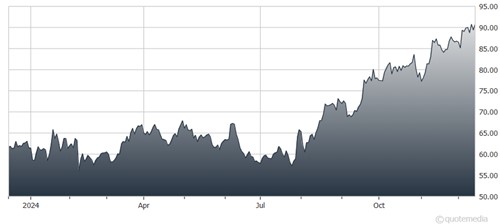

PayPal Holdings Inc. (PYPL)

But after the1995/96 boom, the Internet happened. Stocks kept going up through 1999, only to crash about 50% from 2000 to 2002. So, it took three years of huge gains before that big boom turned into a big bust.

We have a driver similar to the Internet today – Artificial Intelligence (AI). It’s going to remake almost every industry and company over the next decade. And, like 1997-1999, the sarcastic articles are starting to flow: Stocks are expensive...and nobody cares.

As for PYPL, BofA said it’s demonstrating increased turnaround progress just over a year after a C-level management change, which warrants a higher valuation multiple. BofA went on to write: “We see potential ’25 acceleration in underlying TP [transaction profit] growth, recent holiday season e-comm spending data points have been encouraging, and we don’t think potential modest improvement in branded TPV [total payment volume] growth is priced in.”

The firm thinks PayPal’s coming Investor Day on Feb. 25, 2025 could be a positive catalyst and forecast strong free cash flow generation and share buybacks to continue. I’d add that on Feb. 4, PYPL will report December quarter earnings and give 2025 guidance, both of which should be above expectations.

Recommended Action: Buy PYPL.