The stock market’s post-election rally received lots of media attention. But with considerably less fanfare, income investors also got richer between November 5 and the month’s final trading day, the 29th. Meanwhile, Franklin Income Focus ETF (INCM) is a multi-asset ETF I like that seeks high current income and capital appreciation, notes Martin Fridson, editor of Forbes/Fridson Income Securities Investor.

The fund invests in a portfolio of debt and equity securities, overseen by a team with deep experience in multi-asset investing. INCM was launched in June 2023 and is managed to a blended benchmark consisting 50% of the S&P 500 Index and 50% of the Bloomberg U.S. Aggregate Bond Index.

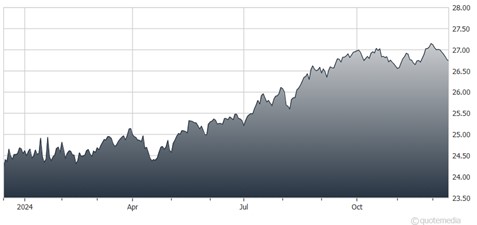

Franklin Income Focus ETF (INCM)

As of Sept. 30, asset allocation was largely composed of Fixed Income (51.57%), Equities (29.17%), and Convertible Securities & Equity Linked Notes (17.01%). Equity Sector Allocation was led by Information Technology (8.3%), Financials (6.45%), Industrials (4.71%), Health Care (4.55%), and Consumer Staples (4.48%).

Fixed Income Allocation as a percent of the total portfolio featured High Yield Corporates (20.39%), Investment Grade Corporates (20.27%), US Treasuries (9.53%), and Mortgage-Backed Securities (1.37).

The fund’s top five portfolio holdings were the S&P 500 Index (8.65%), US Government Securities (4.77%), US Treasury Strip Principal (4.76%), Exxon Mobil Corp. (1.83%), and JPMorgan Chase & Co. (1.63%).

INCM reported a market price total return for the year-to-date period ended Sept. 30 of +9.79%. This compares to the Blended Benchmark total return of +13.03% for the comparable period.

INCM is a suitable closed-end fund investment for low- to medium-risk tax-deferred portfolios. Distributions are largely taxed as ordinary income.

Recommended Action: Buy INCM

Subscribe to Forbes/Fridson Income Securities Investor here…