The US stock market continued its tear earlier this week, led by the biggest and baddest names in the “Magnificent Seven.” Apple Inc. (AAPL) was the only one in the group to close down marginally, breaking its recent win streak, while Tesla Inc. (TSLA) was the belle of the ball, showcases Tom Bruni, head of market research at The Daily Rip by Stocktwits.

Tesla surged 6% on Tuesday, topping its November 2021 highs and cracking $420. A flurry of positive notes from Wall Street summarized the recent cocktail of factors driving the stock. Goldman Sachs was the latest, raising its price target to $350. Since the election, the perceived positives for Tesla have just kept stacking up.

(Editor’s Note: Tom Bruni is speaking at the 2025 MoneyShow Las Vegas, which runs Feb. 17-19. Click HERE to register)

Interestingly, many of the recent upgrades resulted in price targets that are still well below current levels. So yes, many analysts are positive on the stock. But their price targets actually imply there’s downside from here…not upside.

According to Koyfin data, the average rating among the 48 analysts covering the stock remains a “hold.” More notably, the average price target is $260, and the Street’s high-water mark of $421 was surpassed Tuesday.

Despite the obvious disconnect between the analyst notes and their price targets, what’s clear is that the chase is on in Tesla. And nobody is better positioned to benefit from this massive surge than Elon Musk, who just became the first person ever to cross the $400 billion net worth mark. In addition to Tesla, SpaceX’s valuation hit $350 billion as Musk’s “big bets” stack in his favor.

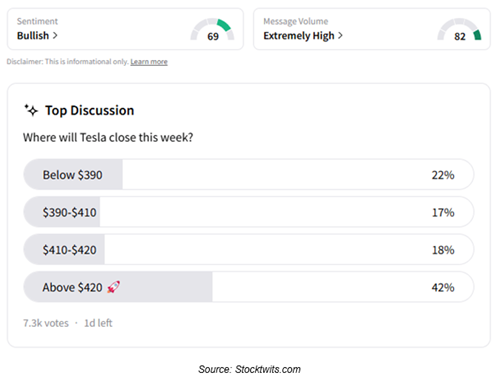

The Stocktwits community was bullish coming into the week, but much like analysts, not bullish enough. With prices already rising above $420, it appears 58% of voters underestimated how far the stock could move this week.

We’ll see how much further the now-eighth-largest stock in the world runs through year-end. But for now, Musk’s mountain of cash continues to grow.