A recent note about shorting stocks over the long term raised a few queries, one of which related to the availability of shares to short. It’s all very well saying we will short X, Y, or Z stock if A, B, or C happens, but if we can’t get our hands on the shares, our idea is worthless, counsels Ian Murphy, founder of MurphyTrading.

Remember: When shorting a stock, someone who already owns the stock gives their broker permission to loan the stock to us and we sell the shares in the hope of buying them back again at a cheaper price to cover our liability.

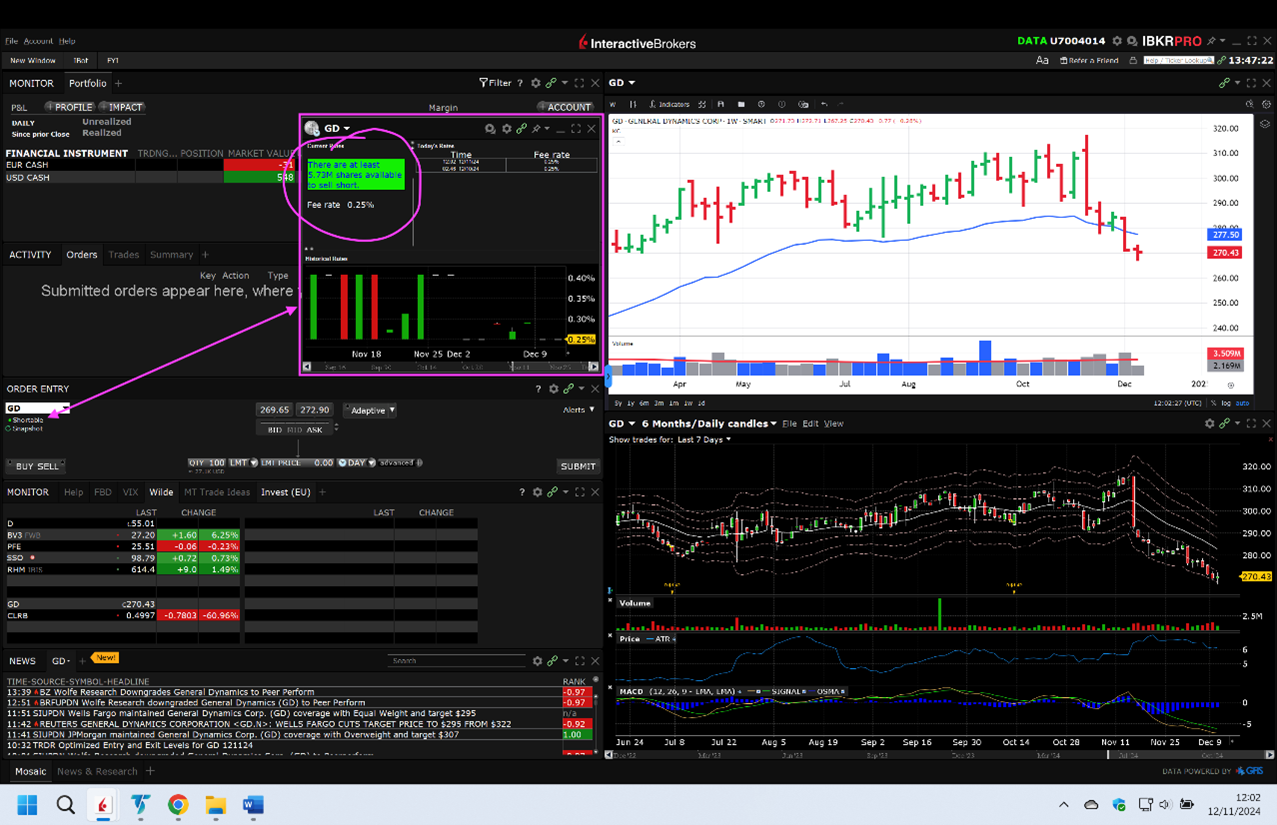

This ties in with the discussion in our online meeting about trading platforms. In general, platforms which are popular with retail investors and institutions have more stocks in-house which they make available for shorting. The two platforms we examined recently have advantages and disadvantages, but Interactive Brokers tends to have a better availability of stocks for shorting than TradeStation.

Going back to General Dynamics Corp. (GD), on Interactive Brokers we can see they recently had 5.73 million shares available as highlighted in pink. That should be enough for anyone.