It’s “Dividend Week.” But if you don’t know what you’re doing as a dividend-focused investor, the results can be catastrophic. Take The Boeing Co. (BA), counsels Pieter Slegers, editor of Compounding Quality.

I recently noted that 700% of the S&P 500’s returns in the last three decades came from dividends. But the real profit potential with dividends is a lot bigger – because companies across the S&P 500 aren’t necessarily the best dividend stocks.

The S&P 500 is a selection made by a committee according to factors such as market cap, trading volume, and earnings. If you hand-select the best dividend stocks, you can find opportunities that can do a LOT better.

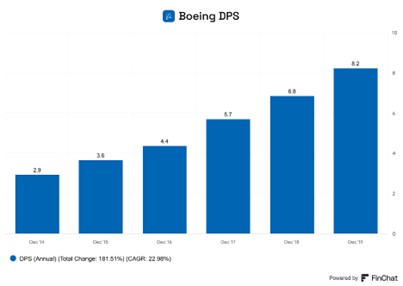

However, that’s where a lot of dividend investors make their biggest mistake. They only pay attention to the dividend payout. In the long run, this approach will NOT maximize your returns. Look at Boeing. The company grew its dividend from 2014 to 2019 at a rate of more than 23% a year:

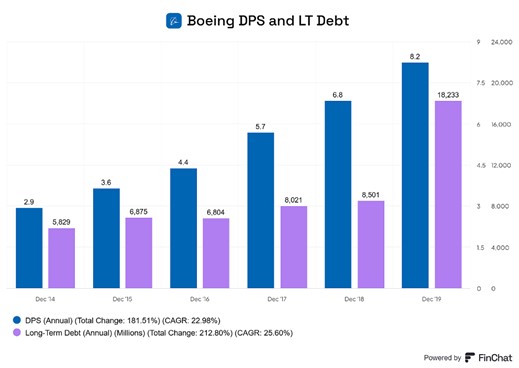

But since revenue and operating income declined, the company had to finance its dividends by growing its debt:

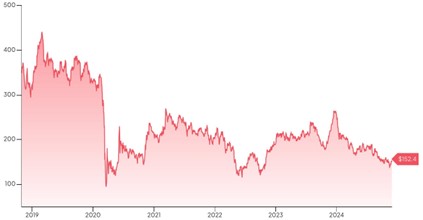

Boeing eventually stopped paying dividends entirely. Not to mention the stock took a nosedive:

That’s why you should NOT just look at the dividend yield when considering a dividend stock. The company’s fundamentals must support a high dividend in the long run.