Americans plan to spend more on holiday shopping this year than they did last year. That’s the takeaway from pretty much every consumer survey conducted over the past several weeks, notes Sam Ro, editor of TKer.co.

We’ll have to wait to see if consumers come through and actually spend more this year. But if they do, it would be consistent with the years-long narrative of record consumer spending. Just recently, we learned retail sales in October rose to a record $718.9 billion.

All this spending has been supported by healthy household balance sheets and real income growth. While households aren’t as flush as they were earlier in the economic recovery, they remain strong relative to history. This is best reflected by the debt-to-income ratio, which remains at historically low levels even as aggregate debt has been rising.

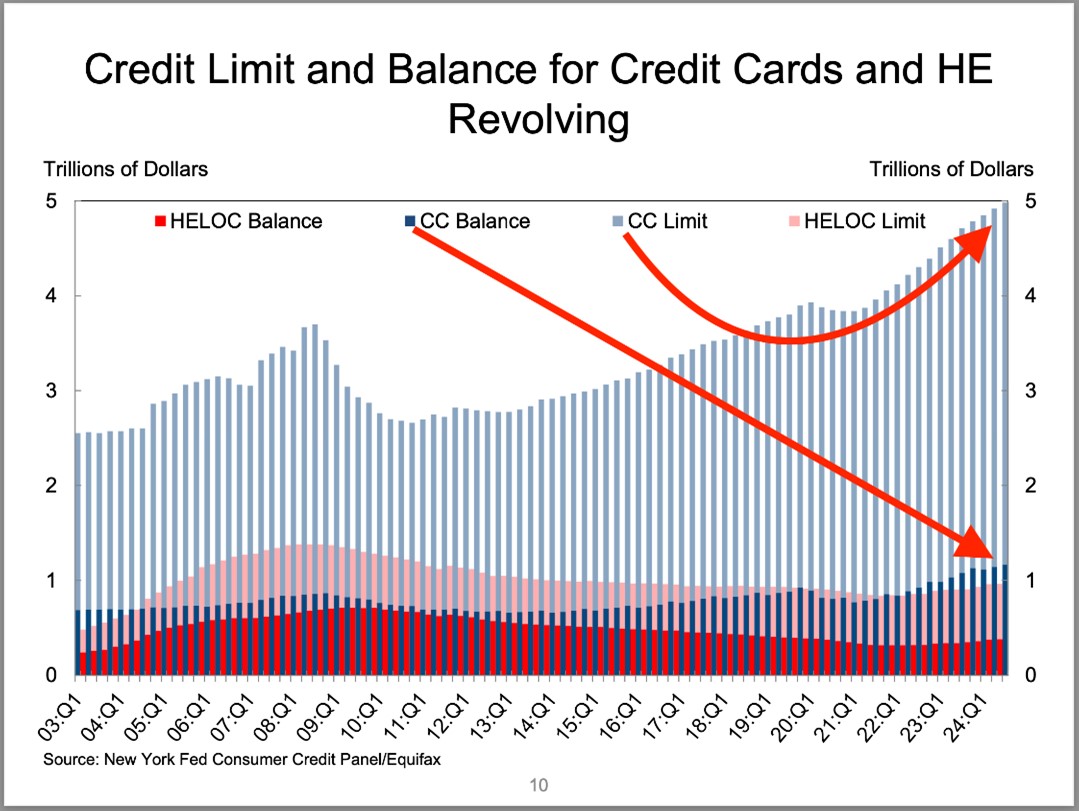

And in case you’re wondering: Households have a long way to go before they max out their credit cards, as the New York Fed chart below shows.

Yes, debt delinquencies have been rising. It’s an economic warning sign to keep an eye on. But for now, they can be characterized as normalizing.

Zooming out: With a new political party moving into the White House next year, we can expect an upheaval in consumer sentiment. But as we’ve learned in recent years, people won’t put their lives on hold just because sentiment is poor. If they have money, they will spend it.