In the last full trading session for the month of November, investors faced two key economic reports – one of which was the Q3 GDP report. It did not have any major surprises. For a bull market riding on optimism, that’s a good thing, says Bret Kenwell, US investment analyst at eToro.

The second revision for Q3 GDP was in-line with expectations, showing an annualized growth rate of 2.8%. While consumer spending — the lifeblood of the US economy — was revised lower, it still grew at an impressive 3.5% rate. That was its best tally since Q4 2023.

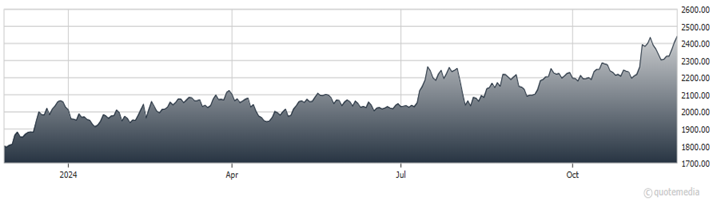

Russell 2000 Index

A weak GDP report could have further moved the needle in favor of another rate cut next month. However, a solid, in-line result was likely to have less of an impact. Focus will now shift to this week’s monthly jobs report as the major influence for the Fed’s mid-December decision. Recent odds for a 25-basis point cut were around 66%.

Quietly, small caps have been dominant, with the Russell 2000 Index up more than 10% in November through mid-last-week. That was the best performance of the major US indices. The Rusell most recently notched a monthly gain of 10% or more in July.