When it comes to how we approach markets, the first thing we want to do is identify which type of market environment we're in. Then, and only then, can we decide which tools and strategies are best for that type of environment. The action in industrials and financials is telling, writes JC Parets, founder of AllStarCharts.

For example, your bear market strategies are probably not going to be great during a bull market. Your trend-following strategies are probably not going to work too well in range-bound markets. Your mean-reverting strategies are probably not going to work during trending environments.

That's the point. You won't want to use a toothbrush to hang a picture on the wall. You've got other tools for that. And so when it comes to deciding which tools and strategies are best for right now, we want to weigh all the evidence to help figure it out.

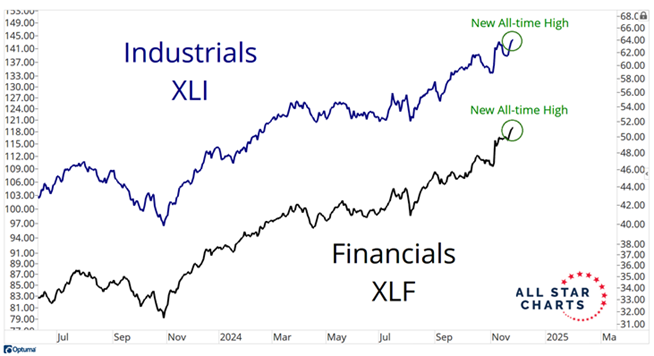

Are the Financial Select Sector SPDR Fund (XLF) and the Industrial Select Sector SPDR Fund (XLI) – two of the most risk-on sector ETFs in the market – making new all-time highs evidence of risk aversion? Or is this evidence of risk appetite? It's by far and away the latter:

With technology taking a back seat through the back half of this year, other sectors have taken over leadership. Sector rotation is the lifeblood of a bull market. More and more stocks, industry groups, and sectors are working.

The small-cap indexes weren't working before. Now they are.

The transportation stocks weren't working before. Now they are.

Consumer discretionary stocks weren’t working before. Now they are.

Financials and industrials were working before. And now they're still working.

Meanwhile, we've had Breakout Multiplier trades in bank stocks, crypto miners, consumer products, movie theaters, gold stocks, and even natural gas ETFs. There's something here for everyone.