Civitas Resources Inc. (CIVI) is a roll up of several E&P operators. In recent years, that has led Civitas to bill itself as the largest pure-play oil and gas producer in Colorado. But recent transactions have extended operations into the ever-popular Permian Basin, observes John Buckingham, editor of The Prudent Speculator.

The company now produces about half of its oil-equivalent sales volumes from the Permian, with the remainder coming from assets predominantly scattered across the Denver-Julesburg Basin of the Rocky Mountains.

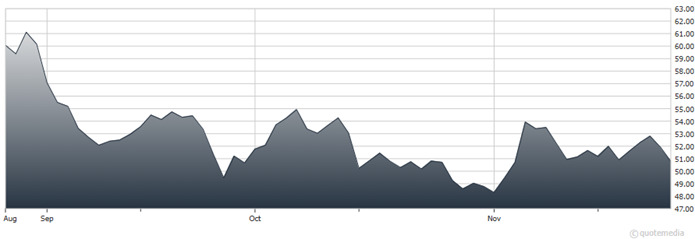

Civitas Resources Inc. (CIVI)

Shares have been smacked since early May, despite CIVI sporting some of the lowest industry lease-operating and per-barrel expenses, and oil prices remaining above the average 10-year level. We find the earnings multiple remarkably low (less than six times NTM adjusted EPS) and like the fixed-plus-variable dividend policy.

The latest adjustment to the variable portion allows the company to use that money to opportunistically buy back stock. CIVI continues to target paying out a hefty 50% of free cash flow (via dividends or buybacks) after the base dividend is paid and the yield was recently 4.9%.

Recommended Action: Buy CIVI.