Last week, President-elect Donald Trump posted on social media that he will slap a 25% tariff on all products coming from Mexico and Canada his first day in office. Similarly, Trump said China will face an additional 10% above any existing tariffs until it stems the flow of illegal drugs into the US. Yet the S&P 500 rose to 6,021.63, a new record high. Here’s why, says Ed Yardeni, editor of Yardeni QuickTakes.

Outside of some weakening in the Mexican peso and the Canadian dollar against the US dollar, markets were unperturbed by Trump's tweet. Perhaps that's because markets have seen this before. Similar negotiations took place before the USMCA trade deal replaced NAFTA in Trump's first term. We continue to recommend a bullish dollar stance regardless of tariff plans.

(Editor’s Note: Ed Yardeni is speaking at the 2025 MoneyShow Las Vegas, which runs Feb. 17-19. Click HERE to register)

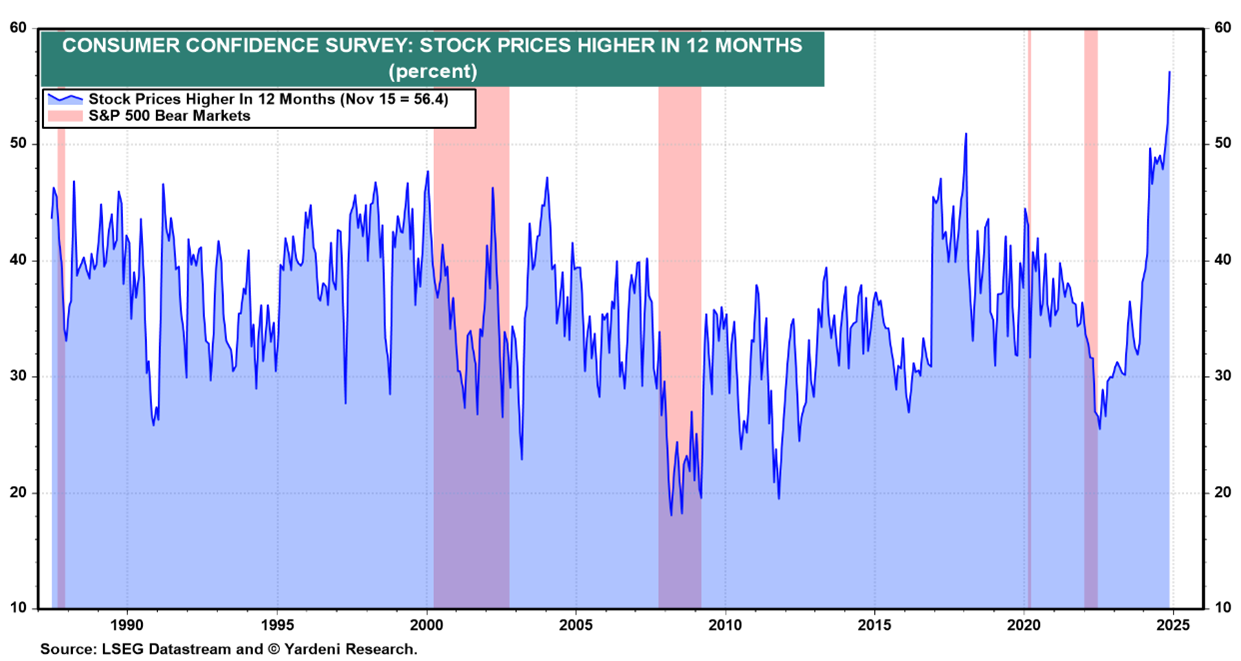

A more immediate risk to the stock market rally than tariffs is that investors are getting too bullish. If there's one thing Americans seem to agree on, it is that stocks are going up. Expectations for stock prices to be higher in 12 months hit a new all-time high in November's Consumer Confidence Index (CCI) survey. From a contrarian perspective, this suggests that a pullback is likely.