Another week of portfolio outperformance reveals two simple truths about long-term success on Wall Street: Sometimes overconfidence is the only enemy in sight...and great stocks can go a staggeringly long way before they finally hit a limit. Spotify Technology SA (SPOT) is one example, highlights Hilary Kramer, editor of Game Changers.

We have plenty of reasons to feel mighty confident. Game Changers holdings rallied another 9% recently against “good,” but dramatically less impressive, gains in the broad market. Take what the S&P 500 and Nasdaq did, double it, and you’d still be a little behind our stocks.

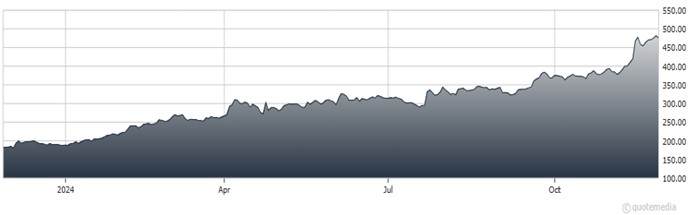

Spotify Technology SA (SPOT)

Granted, we’ve held onto a few of our names longer than usual, raising our overall holding period to about seven months. But those longer-term holdings have rewarded our tenacity.

SPOT is currently our No. 3 trade of all time. Those of you who have been with me for years know that anything nudging 200% is a revelation. It has “only” moved 18X as fast as the S&P 500’s long-term trend.

Where will it go? Remember that second truth on Wall Street: A record-breaking stock can break record after record before it finally hits a wall.

And the first truth is always on my mind. One day, even a record-breaking stock will run out of gas. We need to cash out before we crash. I’m watching. When SPOT gets truly boring and the return rate starts eroding, it’s time to go.

For now, though, the math is our friend. Dropping out of the rally here will cost us a lot of theoretical gains and could mean we leave a lot of money on the table.

Recommended Action: Buy SPOT.