In the near term, I expect inflation to continue to slowly fall – in large part because I still think a brief, shallow recession is coming. But two years from now, I think inflation will be higher as Trump tries to undo many of the policies that he believes weakened the country even as they dampened inflation. I like Palantir Technologies Inc. (PLTR) here, notes Michael Murphy, editor of New World Investor.

Tariffs are inflationary, at least until the Chinese move production to places like Vietnam, South India, and Mexico. Closing the border and deporting illegals will give Americans – and costs – a raise.

Meanwhile, in the “Who’s Left To Buy?” department, after two years of negativity Morgan Stanley finally turned bullish on US stocks. They expect the recent broadening in earnings growth to continue in 2025 (which is already discounted in the market).

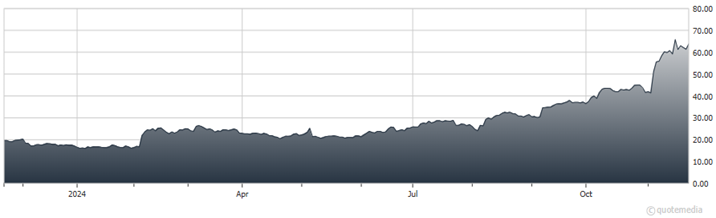

Palantir Technologies Inc. (PLTR)

They raised their rating on US stocks to Overweight, targeting 6,500 at the end of 2025. Their new base target is above their previous bull scenario of 6,350. Now they say in their bull scenario the Index could jump as high as 7,400 next year.

As for Palantir, it joined the S&P 500 on Sept. 23. Jefferies wrote: “Retail ownership has decreased seven points to 42% post the S&P 500 inclusion, while index institutional ownership has increased four points, which may reduce the retail premium going forward.”

Sorry, Jefferies, but that’s not what happens here. The index buying is added to the “retail premium.” Your recent downgrading of the stock from Hold to Underperform and cutting your target price to $28 still makes you look dumb.

Palantir will begin trading as a Nasdaq-listed company this week. The way this will end is that their revenue growth rate will falter. But that is not in sight. Someday, of course – but not yet.

Recommended Action: Buy PLTR.