Align Technology Inc. (ALGN)’s third-quarter results did not show much progress towards regaining its old growth momentum, but some small signs of improvement were enough to give shares a boost, highlights Doug Gerlach, editor of Investor Advisory Service.

Revenue of $978 billion increased 2%, slightly missing both guidance and analyst estimates. Scanners and Services drove the improvement, up 16%. Clear Aligners dropped 1%, with a modest volume increase more than offset by price erosion.

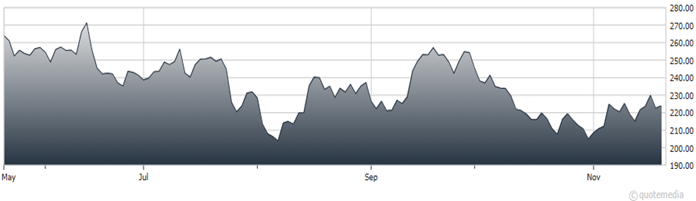

Align Technology Inc. (ALGN)

Average selling price was held back by a higher mix of Asia-Pacific sales. This is expected to reverse next quarter. More structurally, the company continues to segment its markets and discount its products in various ways, offsetting any natural lift from inflation. This has been a long-standing headwind that should eventually reverse.

Profitability was respectable, particularly in light of the revenue miss. Total gross profit increased 3%. EPS of $1.55 declined 2%. Operating income also declined 2%.

Align will embark on a round of cost cutting and expects higher operating margins in Q4 and in 2025. Beyond 2025, margins should improve further due to manufacturing efficiencies and, with hope, leverage from volume growth.

Recommended Action: Buy ALGN.