While there are lots of ways to screen for the best stock plays, I like to use projected earnings growth as a starting point because of the generally positive correlation with stock prices. Vertiv Holdings LLC (VRT) is one name I like, notes Bill Patalon, chief stock picker at Stock Picker’s Corner.

First, though, let’s talk about inflation. You might not know the name Ronald Baron. But take it from me, the octogenarian investment pro is the real deal. He’s worked in the markets for half a century. He founded and still runs New York-based Baron Capital — a fund company with more than $45 billion in assets under management. And he’s got a net worth of $5.2 billion.

So, Baron is a guy worth listening to. Just now, he’s saying that US inflation feels hotter than “the numbers” tell us. And according to an anecdote in Barron’s, the fund manager is backing his assertion.

At the 31st annual Baron Investment Conference, a handout spotlighted the price changes the 81-year-old has experienced “over the past 75-plus years for homes, cars, gasoline, college tuition, steaks, and even golf caddy fees.”

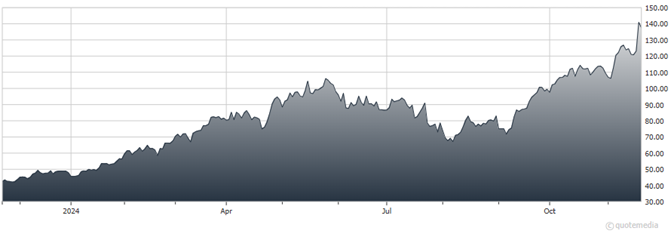

Vertiv Holdings LLC (VRT)

Although the government’s “official” stats show a 3.5% inflation rate during that long stretch, Baron believes it was more likely between 4.5% and 6.5% annually.

“I don’t predict wars. I don’t predict Bitcoin. I don’t predict currency prices. I don’t predict who’s going to become president,” Baron said at the conference. “The only thing I predict is inflation. Everything doubles in price about every 14 or 15 years.”

Baron says investing is the best way to counter inflation’s wealth-eroding power. His preferred method: Growth stocks. Higher stock prices tend to follow earnings growth.

Earnings growth for the S&P 500 is projected at 12.2% next year. VRT is one company that is expected to easily outpace that growth. The firm offers something for every stage of a data center’s lifecycle.

Its modular offerings allow companies to expand capacity quickly. It also markets cooling solutions and management and monitoring tools. Earnings are expected to grow 30.9% next year.

Recommended Action: Buy VRT.