Stocks recently came under pressure as geopolitical issues stole the headlines (Vlad lowering the bar to use nukes against Ukraine after Ukraine used US-made missiles to attack Russia). Here are some thoughts on stocks, gold, and oil, writes Kenny Polcari, chief market strategist at SlateStone Wealth.

Vlad also reiterated that the missiles okayed by the Biden Administration over the weekend raise the stakes. You could feel the nervousness and, by the way, the US closed its embassy in Kyiv later after receiving specific information about more potential air strikes. The VIX (fear index) spiked 14% in the early morning Tuesday before the open, then again after the opening. By the end of the day, the Dow lost 120 points, but the S&P added 24 and the Nasdaq rose 196.

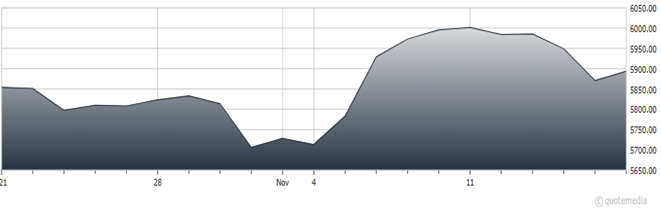

S&P 500

Oil also rallied on the back of the rising geopolitical tensions, and Wednesday morning it kissed trendline resistance at $70.13. If it fails to hold, then we remain in the $66/$70 range. A push up and through should see oil test trendline resistance at $72.

Gold bounced off intermediate trendline support at $2,580 – moving up on the back of those rising Russian/Ukraine tensions. Think the “safe haven play” again. The move in gold will now be driven by all those headlines until those headlines change. Any uptick in tensions will cause a range of investors to jump in. And don’t forget Goldman’s latest call. The firm expects gold to trade up to $3,000 next year, which represents a 15% move up.

Shifting back to the S&P, it closed at 5,916 earlier this week after testing a low of 5,855 – leaving us short of filling that gap created on Nov. 6. I am still in the camp that we need to fill it. But if we get a surge back towards 6,000 after Nvidia Corp.’s (NVDA) earnings...since we are also getting close to that “Christmas rally” time frame…It’s going to be an interesting time.

As an investor, you want to see the market consolidate and trade a bit lower. As a day trader, you want more volatility. My sense is that we will trade up but then back off and fill the gap and test trendline support before we make a renewed move higher. I suspect that we will be in the 6,000 range by year-end.