I thought earnings season was pretty darn good. The only disappointment as of Nov. 10 was materials. Earnings are outpacing the macro economy as companies expand margins faster than revenue growth. As for manufacturing, here are some thoughts, says Nancy Tengler, CIO at Laffer Tengler Investments.

We have long argued that productivity would save the day and it seems to be showing up to do the heavy lifting. For my part, I would like to see revenue growth accelerate. But as we have discussed in the past, in a decelerating economy real revenue growth has actually been decent. This is the fifth consecutive quarter of 5% revenue growth and real revenue growth has shifted to +2.0% to +2.5%.

Meanwhile, the ISM Manufacturing data has been dreadful. We hope to see that shift as interest rates come down and potential corporate tax cuts become a reality along with tariffs. “Build it at home” was part of the incoming president’s campaign rhetoric. We will see.

(Editor’s Note: Nancy Tengler is speaking at the 2024 MoneyShow Masters Symposium Sarasota, which runs Dec. 5-7. Click HERE to register)

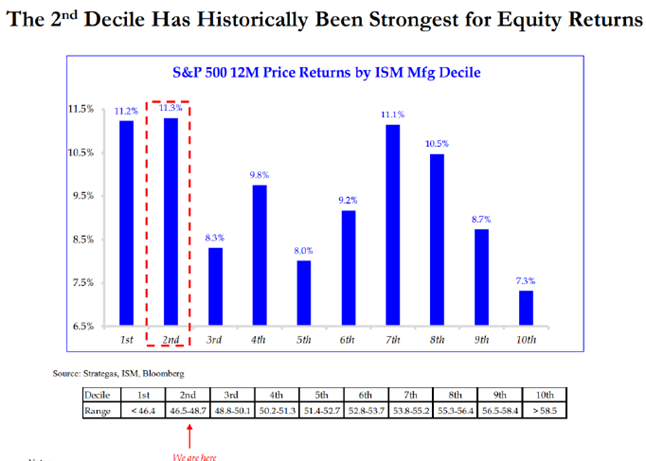

Still, weak manufacturing ISM reports have been followed by strong S&P 500 returns. The chart here shows this clearly. Current ISMs have been in the second decile (contractionary)...and that has resulted historically in the strongest equity returns of all deciles. The weakness reflects a turn – and we think we are turning.

In other words, while manufacturing ISM data stinks, that may be good for stocks. We are overweight Industrials and have been for two years.