Industrials are one of my preferred sectors to invest in as we move into 2025. One of my favorite stocks is Valmont Industries Inc. (VMI), suggests Steve Reitmeister, editor of Zen Investor.

Why industrials? First, because as the Fed lowers rates, it reduces the cost of borrowing, which is a big expense for most of these manufacturers. Second, the Trump Administration is very keen on raising tariffs on China, which would most certainly benefit US-based manufacturers.

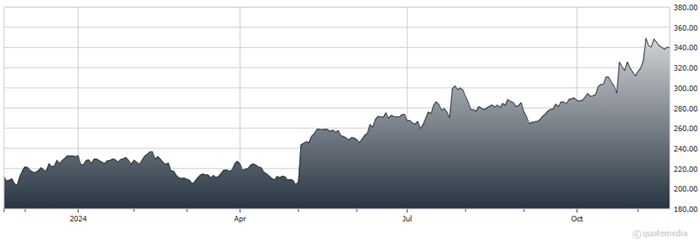

Valmont Industries Inc. (VMI)

VMI focuses on two primary markets, infrastructure and agriculture. These business concentrations are paying off with consistent year-over-year growth.

Yes, there was a little earnings hiccup in early 2023. Since then, VMI has manufactured seven straight beat-and-raise quarters. The most recent beat got analysts sharpening their pencils to increase the earnings outlook for the future. In fact, two of the top analysts in our coverage are pounding the table on the shares:

- A $360 target from Nathan Jones of Stifel Nicolaus (top 2%)

- A $380 target from Brent Thielman of DA Davidson (top 1%)

One of the best attributes of VMI is the positive view from the 118 factors in the POWR Ratings model. VMI comes out with flying colors in the top half percent (yes, 99.5th percentile). Here we find their greatest attribute to be the consistency of growth. Not just earnings but revenues, cash flow, and profit margins as well.

The 38 due diligence checks in the Zen Score also help to corroborate this story of strong fundamentals for VMI. Whereas the average industry peer only scores a 29 for the Zen Score, VMI is a much more impressive 51. Once again, its financial strength is what stands out the most.

Shares have pulled back a notch from recent highs, as have many other quality stocks. This gives you a chance to buy this dip for ample upside ahead.

There may be more scintillating growth stories out there…but most come with a lot more risk. This is a very appealing growth-and-value story where the upside reward potential is far greater than the downside risk. Kind of like the story of the “tortoise and the hare”.

Recommended Action: Buy VMI.