The market leveled off recently after the huge election surge. Stocks are trying to find a more sober post-election footing. I like AGNC Investment Corp. (AGNC) as a “Buy” here, notes Tom Hutchinson, editor of Cabot Income Advisor.

The initial reaction to the Trump victory was higher growth expectations and a surge in cyclical stocks countered by a spike in interest rates. We’ll see if those trends continue after the market fully digests the election.

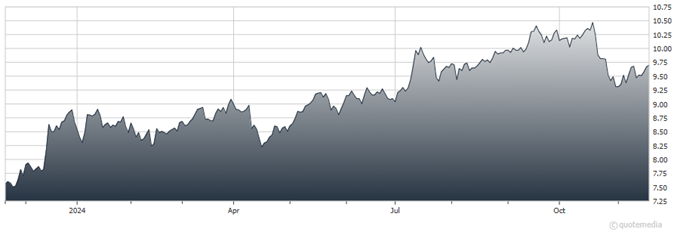

AGNC Investment Corp. (AGNC)

The expectation is for a higher level of economic growth next year and beyond, with still-high interest rates. But those things could take a while, and the market hates waiting. It will still be two months before Trump takes office and much longer for policy changes to have a tangible effect. It’s anybody’s guess how the market behaves in the limbo phase.

Meanwhile, it’s a big week for earnings because Artificial Intelligence (AI) bellwether Nvidia Corp. (NVDA) reports earnings. NVDA set off the huge rally in AI after its first-quarter earnings report last year. A positive reaction to the report could ignite other stocks in that realm, including Qualcomm Inc. (QCOM).

As for AGNC, it yields a healthy 15%. The mortgage REIT had been hitting new highs but took a hit after its earnings report in mid-October. Costs were higher and the net spread shrank from the prior quarter.

Although interest rates are likely to trend lower over the next year, the still-high rates are biting. The deterioration of the interest rate story is more of a short-term issue. The stock is still on track for improving performance over the next year.

Recommended Action: Buy AGNC.