Two giants are reporting earnings this week: Nvidia Corp. (NVDA), providing a benchmark for the growth of AI, and Walmart Inc. (WMT), shining light on the health of the consumer. The economic calendar is light, summarizes John Eade, president of Argus Research.

Meanwhile, Wall Street will continue to evaluate if the Fed is likely to cut interest rates further at their next (and final for 2024) policy meeting next month. Chairman Jay Powell made comments last week suggesting that the Fed is in no hurry to act.

The Dow Jones Industrial Average finished the week with a decline of 1.2%, the S&P 500 was lower by 2.1%, and the Nasdaq fell 3.2%. For the year, the Dow is higher by 15%, the S&P is up 23%, and the Nasdaq has popped 24%.

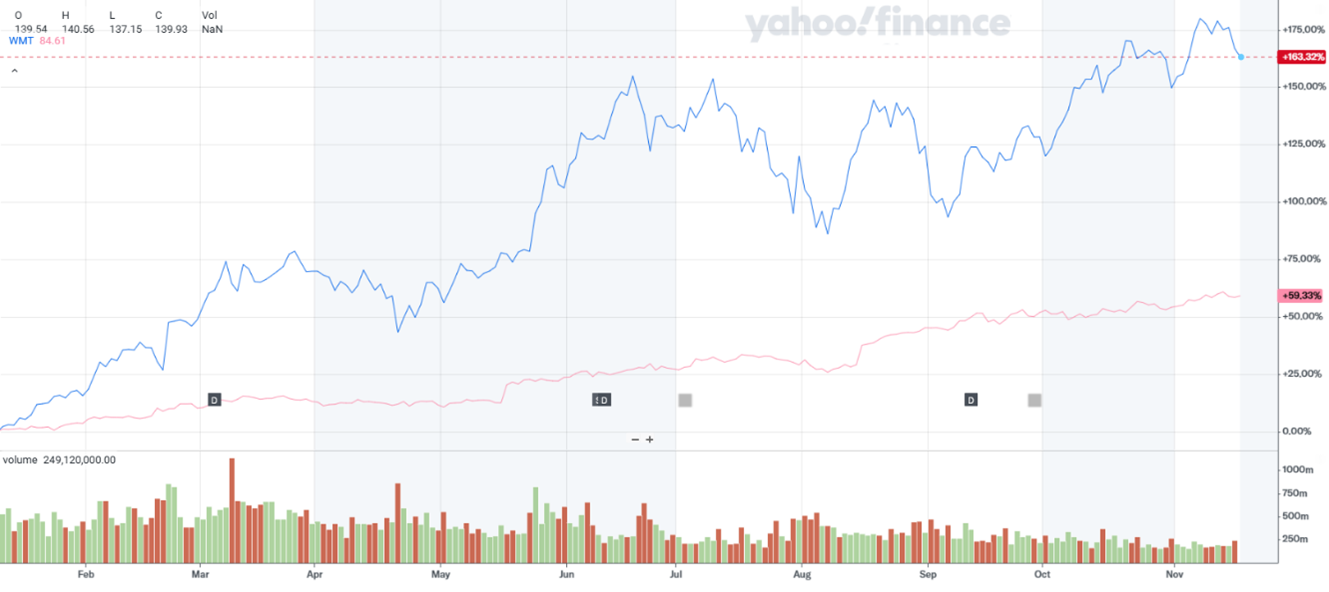

NVDA, WMT (YTD % Change)

Today, Lowe’s, Medtronic, Spotify, Tyson Foods, and AstraZeneca are among the companies that also report. On Wednesday, Nvidia, Snowflake, Palo Alto Networks, Target, TJX, and William-Sonoma will weigh in. On Thursday, it will be Intuit, Warner Music, The Gap, BJ’s, and Deere.

So far, 460 of the S&P 500 companies have reported and earnings are coming in 8.8% higher than in the prior-year quarter. Communication Services, up 26%, and Technology, up 17%, are leading. Energy, down 26%, is underperforming.

Based on our outlook for continued economic growth through 2025, we have raised our 2025 and 2026 forecasts for S&P 500 earnings from continuing operations. For 2025, we are raising our forecast to $276 from $265. Whereas our prior forecast assumed high-single-digit growth, our revised forecast models full-year EPS growth of 11.8%. For 2026, we are raising our forecast to $307 from a preliminary outlook in the $285 range.

Meanwhile, the Atlanta Fed GDPNow indicator is forecasting for 3Q and calling for an expansion of 2.5%. The Cleveland Fed CPINow indicator for November is at 2.71%. Looking ahead, the Fed will make its last interest-rate decision of the year on Dec. 18.

Odds are at 62% that there will be another 25 basis-point (bps) rate cut at that meeting (according to the CME FedWatch tool). We agree – and also expect three more cuts in 2025, all by 25 bps.