After a moonshot among most major indexes following the election and a second Federal Reserve rate cut, the market retrenched a bit last week. Rubrik Inc. (RBRK) is a stock that looks interesting here, notes Mike Cintolo, editor of Cabot Top Ten Trader.

The pullback happened because the Fed hinted that more rate cuts are a coin flip, while Treasury yields picked up again and some profit taking set in. While election week initially brought lots of excitement, we’ve been careful to keep our feet on the ground, partly because the post-election rush higher came after a couple of very good months.

So, we’re monitoring this retreat carefully. Many indexes finally broke out on the upside after four months of being capped, so if those moves completely failed, it would be a yellow flag. The same goes for some recent earnings winners, which have wobbled after big gaps.

Rubrik Inc. (RBRK)

Even so, while we’re keeping our eyes open and are gradually raising stops and taking partial profits (makes sense given some of the windfall gains of late), we advise you to remain bullish. And if you do have some extra cash on the sideline (whatever that means to you), it’s probably a good time to have a shopping list put together. A bit more digestion and retrenchment followed by renewed upside could trigger some decent “resumption” entries, as we call them.

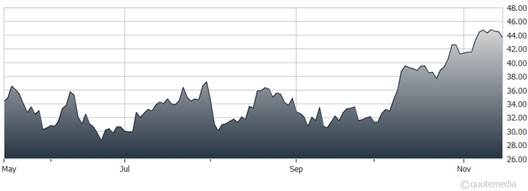

As for RBRK, it changed character in early October and zoomed to new highs near $45, where it sat around for a few days before a more-recent dip. Earnings aren’t out until Dec. 5. If you can get it near $42 to $43 or so, we’re okay grabbing some shares with a stop in the $38 area, give or take.

Recommended Action: Buy RBRK.

Subscribe to Cabot Top Ten Trader here...

(Editor's Note: To download The Golden Era: 3 Powerful Forces Driving Precious Metals Higher (& How YOU Can Profit!) Report, click HERE)

More From MoneyShow.com: