The launch of Madrigal Pharmaceuticals Inc.’s (MDGL) NASH drug Rezdiffra exceeded all expectations in the recent quarterly earnings release. The stock rose more than 50% in a few days – and the company now has a market cap of close to $8 billion. Madrigal has been a long-time top pick, highlights John McCamant, editor of Medical Technology Stock Letter.

Novo Nordisk A/S (NVO) recently released topline results from Part 1 of ESSENCE, a randomized Phase III trial of 2.4 mg semaglutide in MASH for 800 patients at 72 weeks. This study had caused an overhang on MDGL shares as widespread use of semaglutide and other GLP-1 drugs for type 2 Diabetes (T2DM) and obesity were considered a threat to MDGL.

While ESSENCE achieved both primary endpoints with stat sig Fibrosis Improvement (FI) and MASH resolution (MR) for semaglutide 2.4 mg vs. placebo, the pbo-adj. efficacy for FI at ~15% (37.0% for semaglutide 2.4 mg vs. 22.5% for pbo) is not the game-changer that investors had feared, thereby lifting a significant overhang on MDGL shares.

In fact, we would not be surprised to see worse results when the full data is presented with the intent-to-treat (ITT) patients given all the expected drop-outs due to side effects.

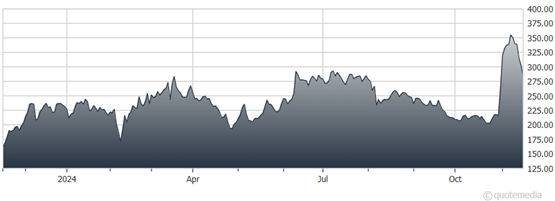

Madrigal Pharmaceuticals Inc. (MDGL)

Overall, the MASH/NASH market is poised to explode with NVO’s entry. As noted by MDGL management, with semaglutide’s expanded label for NASH, NVO’s entry into the commercial NASH market could be a benefit in expanding the addressable population.

NVO estimates there are 22 million patients globally with obesity/type 2 diabetes (T2D) that it would look to target with semaglutide (nearly 70x greater than MDGL’s target of 315k F2/F3 NASH patients, into which Rezdiffra has penetrated only 2% thus far). In our view, NVO’s entry into the MASH/NASH market will have a huge positive impact for Rezdiffra.

Recommended Action: Buy MDGL.