The rally since the election has continued, with Bitcoin reaching $90,000 for the first time and the KBW Nasdaq Bank Index, which tracks shares of some of the nation’s largest lenders, surging. Dutch Bros Inc. (BROS) shares also jumped 36% this week, observes Carl Delfeld, editor of Cabot Explorer.

That said, while we watch what Warren Buffett will do with his gigantic pile of cash, I’m reminded of the “Buffett Indicator,” which measures where stock valuations stand at any given moment. It is a ratio of all listed stocks to the size of the US economy.

Taking the Wilshire 5000 Index as a proxy, it is now around 200%, which would leave it more stretched than at the peak of the tech bubble. This is why some believe that annual returns for US stocks might be lower than the last few decades, though Vanguard’s 10-year projections range from 7% to 9% a year for non-US developed market stocks to 5% to 7% for US small-cap stocks.

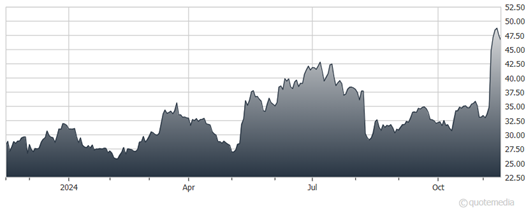

Dutch Bros Inc. (BROS)

As for BROS, it beat analysts’ expectations on the top and bottom lines while offering improved guidance for the remainder of 2024. In addition to growing its store count and sales by 20% and 28%, respectively, compared to last year, the drive-thru coffee chain operator and franchisor posted revenue of $338 million in the period.

The American drive-thru coffee chain went public at $23 a share. Dutch Bros now has 950 outlets.

Recommended Action: Buy BROS.