While the market has come a long way in the past week, it’s fairly clear now that simply knowing the election results is not enough on its own to lift key stocks much higher. After all, inflation remains stubborn, which makes it harder for the Fed to keep cutting interest rates. I think we’re in one of the most defensive spots on Wall Street with call options on the Utilities Select Sector SPDR ETF (XLU), writes Hilary Kramer, editor of 2-Day Trader.

Most traders are now convinced that we’ll get one more, small cut next month and then the Fed will take a break for at least a meeting or two. After that, the future looks more nebulous. I think some traders are waking up to that reality now. The future is never as bad as some dread, but it’s rarely as uninterruptedly great as some hope.

In other words, reality is sinking in. Stocks that were overheated going into the election remain overheated, with only a little refreshment from the Fed’s grudging move. Hope is no match for clear guidance on policy.

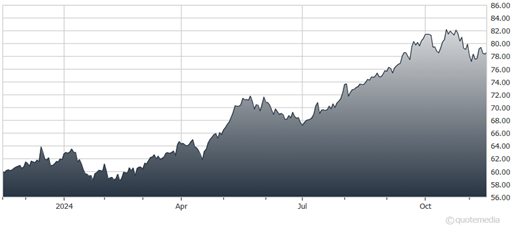

Utilities Select Sector SPDR ETF (XLU)

Will taxes go down? How much? Will tariffs help or hurt? Which companies? Wall Street is rarely comfortable with open questions for long. We might see the market give back a little of its recent gains until we have answers.

Utilities are a classic haven. Our current calls are down now, but we’ve seen similar positions come back with a vengeance. The $81 strike price is not hugely aggressive. But it will require XLU to push a few dollars higher, reclaiming first the 50-day trend and then the 20-day line. I think that can happen.

XLU is still holding nine-day support. That line has flattened out as a tentative but tangible floor. As long as XLU can hold here, the next move is more likely to hit $79 than $77. In that scenario, our calls should improve. All we need to do is watch. Other trades are coming to layer around XLU while we wait.

Recommended Action: Hold XLU calls.