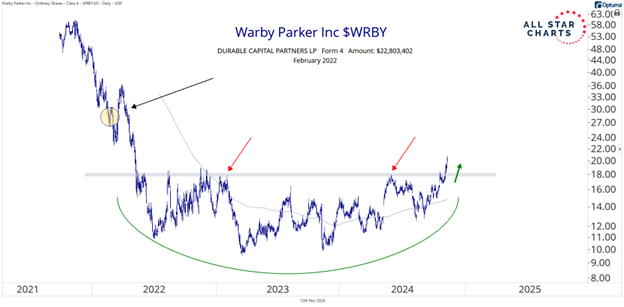

In February 2022, Durable Capital filed a Form 4 with the SEC, disclosing a significant purchase of $22 million of Warby Parker Inc. (WRBY). We now have an opportunity to join a brand-new uptrend at a significant discount from what insiders paid, notes Steve Strazza, director of research at AllStarCharts.

Warby Parker is an eyewear brand known for its trendy and affordable prescription glasses, contact lenses, and sunglasses. Durable Capital owns 6.8 million shares, roughly a 7% interest. The stake is worth about $140 million based on Monday’s closing price.

Founded in 2019, the fund has quickly gained a strong reputation, with assets under management (AUM) estimated at around $7 billion. Durable Capital's investment approach often targets innovative companies with high growth potential, particularly in the tech and consumer sectors.

The hedge fund began building its position as soon as WRBY came public back in 2021. As such, it paid far higher prices and dealt with significant opportunity cost, as the stock has been trending lower or sideways since the IPO.

But that’s all changing. These rounding-bottom formations can be frustrating, as a stock needs time to repair the existing damage before reversing its trend higher. For this reason, we look for a clear and decisive breakout of these bases before getting involved.

Still, it looks like WRBY is starting to set up well for us.

Recommended Action: Buy WRBY.