Ninety-five years of data show September and October, on average, to be the two worst months of the year. This time around, the scary duo was volatile, providing both tricks and treats. But when all was said and done, the period ended with a slight advance. Benchmark Electronics Inc. (BHE) is a name I like here, advises John Buckingham, editor of The Prudent Speculator.

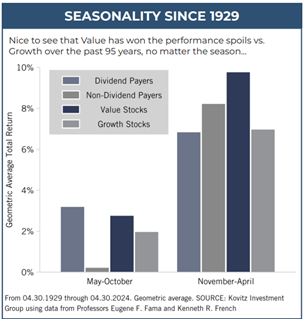

We are pleased that the calendar has now hit the Thanksgiving month, and the start of the seasonally favorable six months of the year. Indeed, Halloween to May Day has seen terrific performance, on average, since 1990 and going all the way back to 1929. Value Stocks historically have asserted their dominance during this span, too, even as Dividend Payers have lagged Non-Dividend Payers.

Happily, despite the war in Ukraine, hostilities in the Middle East, the usual economic worries, and questions about potential Federal Reserve action, the latest November-through-April total return more than lived up to its positive precedent as the Russell 3000 Value index soared 18.3%.

Happily, despite the war in Ukraine, hostilities in the Middle East, the usual economic worries, and questions about potential Federal Reserve action, the latest November-through-April total return more than lived up to its positive precedent as the Russell 3000 Value index soared 18.3%.

As for BHE, it is an electronics manufacturing and design services firm. The company reported Q3 results that were broadly positive, but shares initially retreated and the YTD gain is now only 68%.

Benchmark had $0.57 of EPS (vs. a $0.52 estimate) with $658 million of revenue (vs. a $650 million est.). CEO Jeff Benck said: “While demand over the last few quarters has certainly stabilized, we continue to see end market softness in several sectors, weighing on our opportunity to grow revenue year-over-year.”

Management went on to say the Electronics Manufacturing & Services industry is entering a multi-year growth cycle that can survive any near-term macroeconomic headwinds. Benchmark’s balance sheet remains strong with cash greater than (inexpensive) long-term debt, while analysts believe the company can grow earnings handsomely over the next three years. The dividend yield was recently 1.5%.

Recommended Action: Buy BHE.