The market just ripped higher due to Donald Trump’s victory. Bond yields spiked as well. But the best thing you can do during volatile times like this is to sit back and wait for things to settle down. As for high-yielding Nordic American Tankers Ltd. (NAT), I see some issues, explains Marc Lichtenfeld, chief income strategist at Wealthy Retirement.

There are a lot of factors to take into account in trying to determine which way the market will move going forward. You shouldn’t put too much weight on this action. But one positive for dividend investors is that likely lower corporate taxes in a Trump Administration should mean that companies’ free cash flow will increase. That will help them pay for and hopefully raise their dividends.

As for NAT, in 2021 I compared it to a crazy friend who you could either have the time of your life with or who could get you arrested. The problem with the shipping company’s dividend safety was that its dividend and free cash flow were as consistent as a contractor’s estimate for when your kitchen will be finished.

Since 2021, some things have improved. Free cash flow turned positive in 2022, grew in 2023, and is expected to nearly double this year. However, there’s still a big problem: Last year, the company paid out 136% of its free cash flow in dividends. In other words, it could not afford the dividend it paid to shareholders.

This year, Nordic American Tankers is forecast to pay shareholders 77% of its free cash flow, which is a big improvement over 136% but still a little too high. Generally, I like to see payout ratios below 75% in order to feel comfortable that the company could afford its dividend even if cash flow were to come in below expectations or fall the following year.

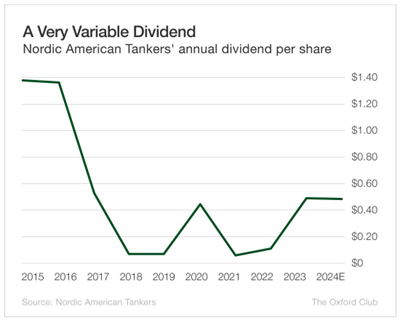

Then there’s the issue of the dividend. In each of the past three quarters, the company has paid out $0.12 per share, which comes out to a tasty 15% yield on the stock’s current price. But over the long term, the dividend is all over the place.

To be fair, Nordic American Tankers’ management team isn’t schizophrenic when it comes to the dividend. The company simply has a variable policy that states that the dividend is based on the previous quarter’s net operating cash flow.

All in all, things are certainly better now than they were when I last reviewed the stock in 2021. Cash flow and the dividend have both increased. The likelihood of a dividend cut remains very high, though, which is not surprising for a stock that yields greater than 15%.